This week, we’re celebrating Ethereum’s 9th birthday – that’s right, our favorite blockchain is entering its tweens and like any pre-teen, it’s full of promise, drama, and the occasional inexplicable meltdown.

In this post, we take a roller coaster ride through Ethereum’s journey from a starry-eyed whitepaper to the drama queen of the crypto world. We’ll laugh, we’ll cry, and we’ll probably loose some ETH along the way – but isn’t that just part of the fun?

Ladies, gentlemen, and smart contracts, gather ’round as we celebrate the 9th anniversary of everyone’s favorite blockchain teenager, Ethereum!

It’s been a wild ride filled with more drama than a season of ‘Keeping Up with the Kardashians,’ only with more acronyms and fewer contouring tutorials.

In the Beginning . . .

Back in 2013, a fresh-faced Vitalik Buterin, barely old enough to buy a lottery ticket, was already knee-deep in the Bitcoin rabbit hole. But like a tech-savvy Oliver Twist, he wanted more. Bitcoin’s limited scripting capabilities left him unsatisfied, dreaming of a blockchain that could do more than just transfer magic internet money.

Inspired by his experiences in World of Warcraft (yes, literally – World of Warcraft the game), where Blizzard nerfed his beloved warlock’s Siphon Life spell, Vitalik realized the dangers of centralized services. This gaming heartbreak, combined with his work on Colored Coins and MasterCoin, led to the birth of Ethereum.

Vitalik’s original vision, outlined in the Ethereum whitepaper, was nothing short of revolutionary. He proposed a ‘world computer’ – a blockchain with a built-in Turing-complete programming language. This wasn’t just adding a few new opcodes to Bitcoin; it was reimagining what a blockchain could be.

The founding team was a crypto dream team:

- Vitalik Buterin

- Anthony Di Iorio

- Charles Hoskinson

- Mihai Alisie and

- Amir Chetrit

Later,

- Joseph Lubin

- Gavin Wood and

- Jeffrey Wilcke

joined the merry band.

It was like the blockchain version of Ocean’s Eleven, minus the heist (well, sort of).

Gavin Wood, with his background in formal verification, brought technical rigor to the project. He introduced the concept of ‘gas’ to solve the halting problem and wrote the Yellow Paper, Ethereum’s technical bible. It was denser than a neutron star and about as easy to digest, but it laid the groundwork for Ethereum’s technical implementation.

However, like any good drama, tensions arose. Disagreements over whether Ethereum should be a non-profit or commercial entity led to a split. Charles Hoskinson and Amir Chetrit left the project in June 2014, with Hoskinson later founding Cardano, a for-profit blockchain, while Vitalik and a few wanted Ethereum as a non-profit blockchain (talk about a crypto soap opera).

The Ethereum Foundation was established in Switzerland, a country as neutral as Ethereum aspired to be decentralized. The initial $ETH sale in 2014 raised over 31,000 BTC, worth about $18 million at the time!

Participants bought $ETH with $BTC, receiving 2,000 $ETH per 1 BTC. Some early buyers are probably still kicking themselves for not hodling (trust me, it is not misspelt, I actually mean hodling, a crypto vocabulary) that BTC, while others are lounging on yachts bought with their ETH gains.

The development of Ethereum wasn’t just a walk in the park; it was more like a sprint through a minefield while juggling chainsaws. The team had to create everything from scratch:

- The Ethereum Virtual Machine (EVM)

- The Solidity programming language, and

- The Mist browser

Solidity, created by Gavin Wood, Christian Reitwiessner, Alex Beregszaszi and several others, became the primary language for Ethereum smart contracts. Its syntax, similar to JavaScript, made it accessible to web developers, but its design choices would later lead to interesting ‘features’ (read: vulnerabilities) that would keep security auditors employed for years to come.

The genesis block of Ethereum was finally mined on July 30 2015, marking the official birth of the network. The first words written into Ethereum’s genesis block?

“The Times 03/Jan/2009 Chancellor on brink of second bailout for banks” – the same message found in Bitcoin’s genesis block. It was a nod to Bitcoin, a declaration of ideological alignment and a subtle ‘challenge accepted’ to the traditional financial system.

Little did anyone know that this was just the beginning of a journey that would involve everything from digital cats breaking the network to yield farmers trying to explain impermanent loss to their grandmothers.

Ethereum had arrived and the world of blockchain would never be the same!

The DAO Hack: Ethereum’s Awkward Phase

In 2016, Ethereum faced its first major crisis with The DAO hack. The DAO (Decentralized Autonomous Organization) was meant to be a crowdfunding platform on steroids, allowing investors to pool funds and vote on projects to support. It raised a mind-boggling $150 million in $ETH, making it the largest crowdfunding event in history at the time.

The DAO’s smart contract, written in Solidity, was audited by several experts and even had a security-focused ‘Creation Period.’ However, like a teenager insisting they know better than their parents, it had a fatal flaw that went unnoticed.

On June 17 2016, an attacker exploited a recursive call vulnerability in The DAO’s splitDAO function. This function was designed to allow users to withdraw their funds, but the attacker found a way to call it repeatedly before the contract could update its balance. It was like finding an ATM that handed out cash before deducting it from your account and then using that knowledge to drain the bank.

The attacker managed to drain about 3.6 million $ETH, worth around $60 million in $ETH at the time, faster than you can say ‘reentrancy attack.’ The Ethereum community watched in horror as the funds were siphoned away, powerless to stop it due to the ‘code is law’ principle that smart contracts operated under.

This incident exposed several critical issues:

- The limitations of smart contract audits

- The potential for catastrophic losses due to code vulnerabilities

- The philosophical debate between ‘code is law’ and the need for human intervention in extreme cases

The DAO hack wasn’t just a financial loss; it was a coming-of-age moment for Ethereum, forcing the community to grapple with hard questions about immutability, governance, and the responsibilities that come with creating a ‘world computer.’

The DAO Fork: Rewriting History

The aftermath of The DAO hack led to one of the most controversial decisions in Ethereum’s history: a hard fork that basically said, ‘Nah, that didn’t happen’ to recover the stolen funds. This wasn’t just a technical decision; it was a philosophical battle that would shape Ethereum’s future.

On one side were those who believed in the principle of ‘code is law.’ They argued that intervening would undermine the very concept of smart contracts and decentralization. On the other side were those who felt that the scale of the theft justified extraordinary measures.

The debate raged across forums, social media, and even in-person meetups. It was like watching a family feud play out on a global scale, with billions of dollars at stake.

Eventually, a hard fork was proposed. This wasn’t just a simple rollback; it required carefully crafted code to move the stolen funds to a recovery contract without disrupting the rest of the network. The Ethereum Foundation created a client implementation that allowed users to vote with their processing power.

On July 20 2016, at block 1,920,000, the hard fork was implemented. The stolen funds were moved to a recovery contract, allowing DAO token holders to withdraw their $ETH. But this decision came at a cost.

A portion of the community, led by those who opposed the fork, continued to mine the original chain. This led to the creation of Ethereum Classic (ETC), which maintained the original, unaltered blockchain.

The fork had far-reaching consequences:

- It set a precedent for human intervention in blockchain ‘immutability’

- It led to the creation of Ethereum Classic, splitting the community

- It raised questions about decentralized governance and decision-making in crisis situations

This event shaped Ethereum’s identity and governance model, influencing future decisions and upgrades. It was a stark reminder that in the world of decentralized systems, code may be law, but humans still write and interpret that law.

ICO Mania: The Party Phase

2017 was the year Ethereum went from being the blockchain world’s quiet, nerdy kid to the host of the wildest party in town.

The catalyst?

The ERC-20 token standard and the ICO (Initial Coin Offering) boom it enabled.

The ERC-20 standard, proposed by Fabian Vogelsteller in November 2015, provided a simple interface for creating tokens on Ethereum. It defined six mandatory functions (totalSupply, balanceOf, transfer, transferFrom, approve, allowance) and two optional ones (name, symbol). This standardization made it incredibly easy for anyone with basic Solidity skills to create their own token.

And create they did.

The floodgates opened and suddenly everyone and their crypto-savvy grandma was launching an ICO. Projects ranged from the innovative to the absurd:

- Bancor raised $153 million in just three hours for its decentralized liquidity network

- EOS, promising to be an ‘Ethereum killer,’ raised $4 billion in the largest ICO ever

- Useless Ethereum Token literally told investors it was worthless and still raised $300,000

The ICO craze reached fever pitch in 2017-2018. According to CoinSchedule, 875 ICOs raised over $6 billion in 2017 alone. It was like watching a gold rush, except the gold was digital and the miners were armed with whitepapers instead of pick axes.

This period had significant impacts on Ethereum:

- Network Congestion: The sheer volume of ICO transactions often clogged the Ethereum network, leading to skyrocketing gas prices

- Ecosystem Growth: Despite the many scams, legitimate projects like Ox, Augur, and Golem were born during this period, enriching the Ethereum ecosystem

- Regulatory Scrutiny: The Wild West nature of ICOs attracted the attention of regulators worldwide, leading to increased scrutiny of Ethereum and token sales

- Price Surge: $ETH price surged from about $8 at the start of 2017 to a peak of $1,432 in January 2018

However, like any great party, the ICO mania had to end.

As regulatory pressure increased and many projects failed to deliver on their promises, the bubble burst. The crypto winter that followed was a harsh but necessary sobering-up period for the Ethereum community.

The ICO era, for all its excesses, proved the power of Ethereum as a platform for fundraising and token creation. It attracted developers, investors, and innovators to the ecosystem, setting the stage for future innovations like DeFi and NFTs.

It was Ethereum’s coming-out party, complete with the hangover to prove it!

The Scaling Saga: Growing Pains

As Ethereum’s popularity skyrocketed, it faced a challenge that would make even Hercules sweat: scaling.

The network, designed to process about 15 transactions per second (TPS), was being asked to handle hundreds of thousands of transactions per second. It was like trying to fit an elephant through a cat flap – technically possible, but messy and time-consuming.

The scaling issue came to a head during the CryptoKitties craze of late 2017 (more on that later), but it had been a known problem for years. Vitalik Buterin had proposed solutions as early as 2014, but implementing them on a live, decentralized network worth billions was about as easy as performing brain surgery on yourself.

Several approaches to scaling were proposed and developed:

- ) State Channels: Inspired by Bitcoin’s Lightning Network, state channels like Raiden allowed for off-chain transactions with on-chain settlement. It was like passing notes in class – quick and efficient, but you still had to show your work eventually

- ) Plasma: Proposed by Vitalik Buterin and Joseph Poon in 2017, Plasma was designed to create ‘child chains’ that could process transactions independently before finalizing on the main chain. It was a bit like franchising – let others do the work, but keep the brand name

- ) Sharding: This involved splitting the network into multiple parts (shards) that could process transactions in parallel. It’s like turning your single-core processor into a multi-core beast, but with the added challenge of keeping everything in sync

- ) Layer 2 Solutions: As the scaling problem persisted, Layer 2 solutions gained traction. These included:

-

- Optimistic Rollups: These assume transactions are valid by default and only run computations if challenged. It’s like a teacher assuming all homework is correct unless a student raises their hand.

- ZK-Rollups: These use zero-knowledge proofs to validate transactions off-chain and submit proof on-chain. It’s like showing you’ve solved a Rubik’s cube without revealing how you did it.

Each of these solutions came with its own set of challenges. State channels and Plasma faced issues with mass exits and data availability. Sharding, while promising, required a complete overhaul of the Ethereum network (hello, Eth2).

The scaling saga also gave rise to competing blockchains that promised higher throughput, like EOS, Tron, and later Solana. These ‘Ethereum killers’ added fuel to the scaling fire, pressuring the Ethereum community to find solutions faster.

As of 2024, the scaling journey continues. The transition to Proof-of-Stake with The Merge was a significant step, but full sharding is still on the horizon. Layer 2 solutions like Optimism, Arbitrum, and zkSync have gained significant traction, offering a glimpse of a scaled Ethereum future.

The scaling saga has been a testament to Ethereum’s resilience and adaptability. It’s pushed the boundaries of blockchain technology and inspired innovations that will likely shape the future of decentralized systems. It’s been a long, bumpy road, but as any good trainer will tell you, no pain, no gain.

CryptoKitties: The First Crush

In late 2017, Ethereum had its first viral moment and it came in the form of adorable, breedable, digital cats. CryptoKitties, launched by Dapper Labs on November 28, 2017, was the first blockchain game to gain widespread popularity and it nearly brought Ethereum to its knees.

CryptoKitties was built on the ERC-721 non-fungible token standard, which allowed for the creation of unique digital assets. Each CryptoKitty was a unique token with its own set of ‘genes’ that determined its appearance and traits. Users could buy, sell, and breed these digital felines, with some rare cats selling for eye-watering amounts.

In December 2017, a CryptoKitty named ‘Dragon’ sold for 600 $ETH, worth about $170,000 at the time!

The game’s popularity exploded faster than a cat video on social media. At its peak, CryptoKitties accounted for nearly 25% of all Ethereum network traffic.

This sudden surge exposed Ethereum’s scaling limitations in spectacular fashion:

- Network Congestion: The Ethereum network became severely congested, with pending transactions skyrocketing from about 1,500 to over 11,000

- Gas Price Surge: As users competed to get their transactions processed, gas prices soared. Breeding a cat could cost upwards of $20 in transaction fees

- Delayed Transactions: Many transactions were stuck pending for hours or even days, leading to a backlog of sad, unborn digital kittens

The CryptoKitties craze had several significant impacts:

- Scaling Wake-up Call: It vividly demonstrated Ethereum’s scaling limitations, accelerating work on scaling solutions

- NFT Revolution: CryptoKitties popularized the concept of non-fungible tokens, paving the way for the later NFT boom

- Blockchain Gaming: It showed the potential for blockchain-based games and digital collectibles, inspiring numerous projects

- Mainstream Attention: CryptoKitties attracted significant media attention, introducing many to the concept of blockchain beyond cryptocurrencies

- Gas Price Mechanisms: The congestion led to discussions about more efficient gas price mechanisms, eventually contributing to the development of EIP-1559

The CryptoKitties phenomenon was Ethereum’s ‘Eternal September’ moment – when a sudden influx of new users strained the network beyond its limits. It was a baptism by fire (or rather, by fur), forcing the Ethereum community to confront scaling challenges head-on.

In retrospect, CryptoKitties was more than just a cute distraction. It was a pivotal moment in Ethereum’s history, stress-testing the network, exposing its limitations, and pointing the way towards future innovations. It showed that blockchain technology could be fun and accessible, not just a playground for financial applications and smart contracts.

The legacy of CryptoKitties lives on, not just in the countless blockchain games and NFT projects it inspired, but in the valuable lessons it taught about scalability, user experience, and the potential for blockchain to create new forms of digital ownership and interaction.

Who knew that digital cats could be such effective teachers?

DeFi Summer: The Teenage Rebellion

The summer of 2020 saw Ethereum transform from a playground for ICOs and digital cats into the epicenter of a financial revolution. Decentralized Finance, or DeFi, exploded onto the scene, turning Ethereum into a global, permissionless financial system virtually overnight.

DeFi wasn’t entirely new – projects like MakerDAO had been around since 2017 – but several factors converged to create the perfect storm:

- Compound’s Liquidity Mining: In June 2020, Compound launched its governance token, COMP and introduced liquidity mining. Users could earn COMP by supplying or borrowing assets on the platform. This model, dubbed “yield farming,” set off a frenzy of innovation and speculation

- Uniswap’s Growth: Uniswap, a decentralized exchange using an automated market maker (AMM) model, saw exponential growth. Its simple

x * y = kformula allowed for permissionless token swaps without traditional order books

- Yield Optimization: Projects like Yearn Finance automated the process of chasing the highest yields across different protocols, making yield farming accessible to less tech-savvy users

- Synthetic Assets: Platforms like Synthetix allowed users to create and trade synthetic versions of real-world assets, expanding the range of financial instruments available in DeFi

- Governance Tokens: Many projects launched governance tokens, giving users a stake in protocol decision-making and often distributing them through liquidity mining.

The numbers during DeFi Summer were staggering:

- Total Value Locked (TVL) in DeFi protocols rose from about $1 billion in June to over $15 billion by September 2020

- Uniswap’s daily trading volume surpassed that of Coinbase(yes, that Coinbase, the second largest centralized exchange in the world, second only to the mighty Binance) on some days

- Yield farming opportunities offering APYs in the thousands of percent (though often unsustainable) became common

This period saw the rise of several key projects:

- Aave: A lending protocol that introduced flash loans, allowing users to borrow without collateral for a single transaction

- SushiSwap: A Uniswap fork that sparked the “vampire mining” trend, attempting to siphon liquidity from Uniswap

- Curve Finance: An AMM optimized for stablecoin swaps, becoming a cornerstone of the DeFi ecosystem

DeFi Summer had profound impacts on Ethereum:

- Network Congestion: Once again, Ethereum faced scaling challenges as DeFi activity pushed gas prices to new highs

- Innovation Acceleration: The period saw rapid innovation in financial primitives, from yield aggregators to algorithmic stablecoins

- Regulatory Attention: The explosive growth of DeFi attracted increased scrutiny from regulators worldwide

- Ecosystem Growth: DeFi brought a new wave of developers and users to Ethereum, expanding the ecosystem dramatically

- Interoperability: The need to access Ethereum’s DeFi ecosystem drove the development of cross-chain bridges and Layer 2 solutions

However, DeFi Summer also had its dark side. The period saw numerous hacks, exploits and ‘rug pulls.’ The pseudonymous nature of many projects and the ‘move fast and break things’ ethos led to significant losses for some users.

The summer of 2020 marked Ethereum’s transition from a platform for fundraising and speculation to the foundation of a new financial system. It demonstrated the power of composability in DeFi, where protocols could be combined like ‘money legos’ to create complex financial instruments.

DeFi Summer was Ethereum’s rebellious teenage phase – experimental, risky, and transformative. It pushed the boundaries of what was possible in finance, challenged traditional systems and set the stage for Ethereum’s continued evolution as a global financial platform. Like any good rebellion, it was messy and sometimes destructive, but it laid the groundwork for a new financial paradigm.

The Flash Loan Exploits: Lessons in Risk Management

As DeFi exploded in popularity, it brought with it a new class of financial instruments and inevitably, new vulnerabilities. Enter the era of flash loan exploits, where millions could be made (or lost) in the blink of an eye.

Flash loans, introduced by Aave in 2020, allowed users to borrow any amount of assets without collateral, as long as the loan was repaid within the same transaction. This novel concept opened up new possibilities for arbitrage and portfolio rebalancing, but it also created opportunities for sophisticated attacks.

Some notable flash loan exploits include:

- bZx Exploit (February 2020): An attacker used a flash loan to manipulate oracle prices and drain $350,000 from the bZx protocol. This was one of the first major flash loan exploits, serving as a wake-up call for the DeFi community

- Harvest Finance (October 2020): An attacker used a flash loan to manipulate the price of USDC and USDT on Curve, draining $33.8 million from Harvest Finance. This exploit highlighted the dangers of relying on a single price oracle

- Cheese Bank (November 2020): An attacker used a flash loan to manipulate the price of HUSD and drained $3.3 million from the protocol. This exploit utilized a vulnerability in the way Cheese Bank calculated collateral value

- Warp Finance (December 2020): Attackers used flash loans to manipulate oracle prices, draining $7.7 million from the protocol. This incident underscored the importance of using time-weighted average prices (TWAP) for oracles

- PancakeBunny (May 2021): In one of the largest flash loan exploits, an attacker manipulated the price of BUNNY tokens on PancakeSwap, making off with $45 million. This attack demonstrated how flash loans could be used to manipulate prices even on high-liquidity platforms

These exploits taught the DeFi community several valuable lessons:

- Oracle Vulnerabilities: Many exploits targeted price oracles, highlighting the need for robust, manipulation-resistant price feeds. This led to increased adoption of decentralized oracles like Chainlink and the development of more sophisticated oracle designs

- Economic Attack Vectors: Flash loans allowed attackers to temporarily control large amounts of capital, enabling economic attacks that were previously infeasible. This forced developers to consider new attack vectors in their security audits

- Composability Risks: The interlinked nature of DeFi protocols meant that a vulnerability in one protocol could have cascading effects across the ecosystem. This emphasized the need for comprehensive security audits that considered the entire DeFi stack

- Importance of Circuit Breakers: Some protocols implemented circuit breakers or transaction value limits to mitigate the impact of potential exploits. However, these measures often came at the cost of reduced capital efficiency

- Governance Challenges: Flash loan attacks raised questions about governance security, as some exploits manipulated on-chain voting mechanisms. This led to discussions about implementing time locks and other safeguards for governance decisions

- Insurance and Risk Management: The prevalence of exploits spurred the development of DeFi insurance protocols and more sophisticated risk management strategies

- Code Auditing and Bug Bounties: The exploits underscored the importance of thorough code audits and generous bug bounty programs to incentivize white hat hackers

The era of flash loan exploits was a harsh but necessary learning experience for the DeFi community. It drove improvements in protocol design, security practices, and risk management strategies. Projects like Aave introduced rate limits on flash loans, while others implemented more robust oracle systems and economic incentives to resist attacks.

These incidents also sparked debates about the nature of ‘exploits’ versus ‘arbitrage’ in a space where code is supposed to be law. Some argued that if an action was permitted by the smart contract, it shouldn’t be considered an exploit, regardless of the developer’s intentions.

As the DeFi ecosystem matured, it became better at anticipating and mitigating these types of attacks. However, the cat-and-mouse game between developers and exploiters continues, driving constant innovation in DeFi security.

The flash loan saga demonstrated both the risks and the resilience of the DeFi ecosystem. It showed that while decentralized finance could be vulnerable to sophisticated attacks, it was also capable of rapidly learning, adapting, and becoming stronger in the face of adversity.

In many ways, it was Ethereum’s crash course in financial security, preparing it for its growing role in the global financial system.

NFT Boom: The Fame and Fortune of The Horrible JPEGs

While DeFi was Ethereum’s rebellious teenage phase, the NFT boom of 2021 was its Hollywood moment. Non-Fungible Tokens (NFTs) exploded into the mainstream, turning Ethereum into a playground for digital artists, collectors, and speculators alike.

The NFT craze wasn’t entirely new – CryptoKitties had introduced the concept back in 2017. However, several factors converged to create an unprecedented boom:

- Celebrity Endorsements: Artists like Beeple, musicians like Kings of Leon and celebrities like Paris Hilton jumped on the NFT bandwagon, bringing mainstream attention

- Improved Infrastructure: Platforms like OpenSea and Rarible made it easier than ever to mint, buy and sell NFTs

- DeFi Profits: Many early DeFi adopters were flush with cash and looking for the next big thing

- Lockdown Creativity: The COVID-19 pandemic led to an explosion of digital creativity, with NFTs offering a new way to monetize it

Some notable NFT milestones:

- Beeple’s ‘Everydays: The First 5000 Days’ sold for $69 million at Christie’s auction house

- CryptoPunks, one of the earliest NFT projects, saw individual punks selling for millions of dollars

- NBA Top Shot brought sports collectibles to the blockchain, generating over $700 million in sales

The NFT boom had significant impacts on Ethereum:

- Gas Price Surge: Once again, Ethereum faced scaling challenges as NFT minting and trading drove gas prices to new highs

- Ecosystem Expansion: The NFT craze brought a new wave of artists, collectors and developers to Ethereum

- Innovation in Digital Ownership: NFTs pushed the boundaries of what could be owned and traded digitally, from virtual real estate to social media posts

- Environmental Concerns: The energy consumption of NFT minting and trading on Ethereum’s PoW chain sparked debates about sustainability

- Integration with DeFi: Projects began exploring ways to use NFTs as collateral in DeFi protocols, further blurring the lines between different sectors of the Ethereum ecosystem

The NFT boom wasn’t without controversy. Critics pointed to the environmental impact, the speculative nature of the market and concerns about copyright and authenticity. Nevertheless, it demonstrated Ethereum’s power as a platform for digital ownership and creative expression.

The Merge: Ethereum’s Glow-Up

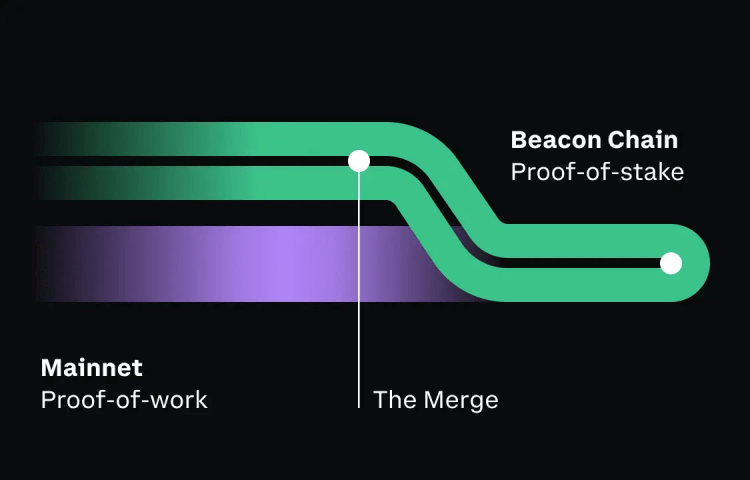

After years of development and anticipation, Ethereum finally underwent its most significant upgrade to date: The Merge. On September 15, 2022, Ethereum transitioned from Proof-of-Work (PoW) to Proof-of-Stake (PoS), marking a new era for the network.

The Merge was a technical marvel, likened to changing a car’s engine while it’s running. It involved:

- The Beacon Chain: Launched in December 2020, this PoS chain ran parallel to the PoW chain, allowing for testing and gradual transition

- The Merge itself: The moment when the PoW chain merged with the Beacon Chain, transitioning the entire network to PoS

- Post-Merge Clean-up: A series of upgrades to optimize the new PoS system

Fun Fact: Did you know that Proof-of-Work (PoW) and Proof-of-Stake (PoS) are NOT consensus protocols by themselves? 🤯🤯

We just use the terms for simplicity. They are Sybil resistance mechanisms and block author selectors. It’s this mechanism combined with a chain selection rule that forms a consensus protocol.

- Sybil Resistance: PoW and PoS prevent Sybil attacks (a situation where one person pretends to be many users) by requiring a lot of energy (PoW) or stake (PoS). This makes it economically hard but not impossible to fake multiple identities

- Block Author Selection: These mechanisms help decide who gets to create the next block

- Chain Selection Rule: This rule helps nodes (computers participating in the chain) choose the correct block when multiple blocks exist

Bitcoin uses the ‘longest chain’ rule, choosing the chain with the most cumulative work while Ethereum uses the ‘weight’ of the chain, calculated from validator votes weighted by their staked Ether.

Ethereum used the ‘longest chain’ rule like Bitcoin before The Merge.

Ethereum actually uses a consensus mechanism called Gasper , which combines Casper FFG proof of stake with the GHOST fork-choice rule – a combination of a Sybil resistance mechanism and a chain selection rule for it’s consensus.

The impacts of The Merge were significant:

- Energy Efficiency: Ethereum’s energy consumption dropped by over 99%, addressing one of the main criticisms of the network

- Reduced Issuance: The shift to PoS reduced the issuance of new ETH, potentially making it deflationary when combined with EIP-1559’s fee burning mechanism

- Improved Security: PoS introduced new security models and made certain types of attacks more costly

- Path to Scalability: The Merge set the stage for future upgrades like sharding, which promise to dramatically increase Ethereum’s throughput

The Merge was a testament to Ethereum’s ability to evolve and adapt, setting it apart from more static blockchain networks.

Legal Battles: The Rebellion Years

As Ethereum grew in influence and value, it inevitably attracted regulatory attention. Key legal issues included:

- Security Classification: The ongoing debate about whether ETH should be classified as a security, particularly given its initial coin offering

- DeFi Regulation: Questions about how to regulate decentralized exchanges, lending platforms and other DeFi applications

- Privacy Concerns: Discussions about the balance between financial privacy and the need for KYC/AML compliance

- Smart Contract Legality: Debates about the legal status of smart contracts and their enforceability in traditional legal systems

These legal battles have forced the Ethereum community to engage with regulators and policymakers, working towards a regulatory framework that balances innovation with consumer protection.

ETFs: The ‘Please Take Me Seriously’ Phase

The quest for an Ethereum ETF represents the blockchain’s bid for mainstream financial acceptance. While Bitcoin ETFs have been approved, Ethereum ETFs face unique challenges:

- Staking Considerations: How to handle staking rewards in an ETF structure

- Network Upgrades: Ensuring the ETF can adapt to major network changes like The Merge

- Valuation Metrics: Developing appropriate methods for valuing Ethereum as an asset

The approval of an Ethereum ETF could potentially bring significant institutional investment to the network.

Privacy Concerns: The “It’s Not a Phase, Mom” Moment

As Ethereum matures, it’s starting to realize that maybe, just maybe, having all your transactions visible to everyone isn’t the best idea.

Enter privacy solutions like zk-SNARKs (Zero-Knowledge Succinct Non-Interactive Argument of Knowledge) and zk-STARKs (Zero-Knowledge Scalable Transparent Argument of Knowledge). These cryptographic proofs allow transactions to be validated without revealing the underlying data.

Projects like Aztec and Tornado Cash have implemented these technologies, creating privacy-preserving smart contracts and mixing services. It’s like Ethereum discovered incognito mode, but for blockchain.

However, these advancements have also raised concerns about regulatory compliance and the potential for illicit activities, leading to ongoing debates about the balance between privacy and transparency in decentralized systems.

The Rise of Competitors: Sibling Rivalry

Throughout its journey, Ethereum has had to fend off countless ‘Ethereum killers.’

Competitors like Solana boast higher transactions per second (TPS) with its Proof-of-History mechanism, while Cardano touts its academically peer-reviewed approach and Ouroboros consensus protocol.

Polkadot introduces the concept of parachains for enhanced interoperability, and Cosmos aims to become the ‘Internet of Blockchains’ with its Inter-Blockchain Communication protocol.

Each of these platforms introduces unique technical solutions to blockchain scalability and interoperability challenges.

However, Ethereum’s first-mover advantage, extensive developer community, and ongoing upgrades (like the upcoming sharding implementation) have helped it maintain its lead. It’s like watching a family reunion where each sibling tries to outdo the others with increasingly outlandish party tricks, while Ethereum sits back, sipping ETH and saying, ‘That’s cute, but can your smart contract run an entire financial system?’

Conclusion

As we wrap up this trip down Ethereum’s memory lane, let’s take a moment to appreciate how far our little blockchain has come. From surviving hacks that would make a Hollywood heist movie blush to spawning an entire ecosystem of tokens that sound like rejected Pokémon names (like what the hell is even BONK or SHIBA INU).

Ethereum has truly been the gift that keeps on giving (and occasionally taking, if we’re honest about those gas fees).

So here’s to Ethereum at 9 – may your future be as bright as a freshly minted NFT, your gas fees as low as the chances of you understanding the entire Ethereum yellow paper in one sitting, your transactions as smooth as Vitalik’s dance moves, and your upgrades less dramatic than a Shakespeare play.

Happy Birthday, Ethereum!

Follow us on X for the latest posts and updates

Join and interact with our Telegram community

_____________________________________

_____________________________________