The latest Decentralized Applications (DApps) industry report for Q1, 2021 is out with impressive growth statistics so far.

The report looks at the entire blockchain industry with a particular focus on DeFi and NFTs, two areas in the blockchain industry seeing remarkable growth.

___________________________________________________________________

SEE ALSO: The Ethereum DeFi Ecosystem Accounted for 95% of All Dapp Transactions Volume in 2020

___________________________________________________________________

We compiled a list of stats from the report as shown below:

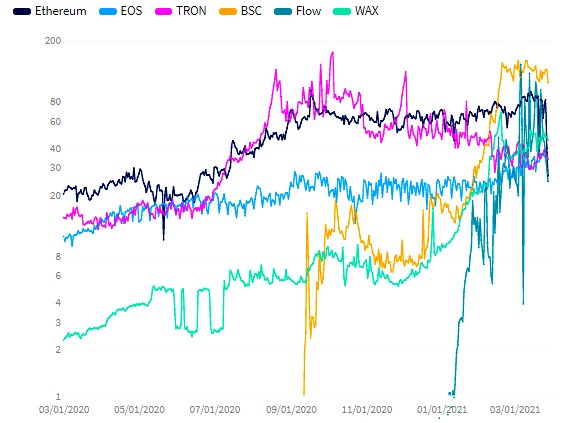

- Daily unique active wallets (UAVs) grew grew by 639% year-on-year, reaching 458,000 from 62,000 in 2020 Q1

- BSC has overcome Ethereum in terms of daily unique active wallets: 105,000 and 75,000 respectively

- Ethereum maintained leadership by generating $54 billion in Total Value Locked (TVL)

- NFTs faced record-high transaction volumes and generated more than $1.5 billion in Q1 2021

- NBA Top Shot maintained its leadership and was the most significant dapp in the NFT space with around $500 million in transaction volumes during Q1 2021

- DeFi dapps continue to seek scalability solutions with Polygon so far proving to be the No. 1 choice for NFT platforms

- 2021 Q1 was a memorable quarter as Binance Smart Chain beat Ethereum in terms of daily unique active wallets. Taking into consideration that several top dapps announced plans to move cross-chain, we might see an even bigger gap between BSC and Ethereum in Q2

- BSC was not only the largest contributor with average daily unique active wallets of 105,000. In March, the chain also had the biggest increase in terms of unique active wallets by 50% month-on-month

- The Ethereum and Flow blockchains generated an average of around 75,000 and 53,000 daily unique active wallets respectively. That means increased usage of 7% in March alone

- One of the most prominent layer-2 solutions, Polygon (formally Matic), faced significant growth in Q1 2021. Daily unique active wallets grew by 496% from 500 to 4800 quarter-on-quarter. Transaction volumes also followed the trend with a growth of 288% reaching $0.5 billion in Q1 2020

- The reason behind the growth has been the DeFi exchange QuickSwap. QuickSwap generated 87% (or $443 million) of total Polygon transaction volume

- With OpenSea, Aave, and Aavegotchi all expected to join the Polygon ecosystem, we can expect the blockchain solution to expand even more. On the other hand, Polygon activity is still far away from Ethereum and BSC heights

- In Q1 2021 Ethereum TVL grew from more than $21 billion to $54 billion quarter-on-quarter. The biggest contributors were MakerDao, Uniswap, and Compound that account for 33% of the total value locked

- At the end of Q1 2021, BSC had around $20 billion in TVL. Comparing quarter-on-quarter growth, TVL grew more than 30x from $0.6 billion to $20 billion

- Although Binance Smart Chain’s TVL is still more than 2 times lower than that of Ethereum, several BSC dapps overcame top Ethereum dapps

- At the end of March 2021, top BSC dapps, Venus and PancakeSwap, had around $6.3 billion and $5.7 billion in TVL respectively. While MakerDAO, Uniswap, and Compound had $6.6 billion, $5.7 billion, and $6.1 billion in TVL. This means that Venus has already surpassed Uniswap and Compound in terms of total value locked

- Uniswap dropped an NFT surprise recently. Uniswap v3 will use NFTs to tokenize liquidity positions. These movements are important for the industry as it shows a path of industry development. It might also change the concept of DeFi projects too where we start to see DeFi and NFTs even more interconnected

- Q1 2021 so far has arguably been all about NFTs. The category generated more than $1.5 billion in transaction volume in the first three months of the year alone

- Even though this is just a fraction when compared with the DeFi ecosystem, the NFT market is facing rapid growth of 2,627% quarter-over-quarter with the biggest contributors being NBA Top Shot, CryptoPunks, and OpenSea that accounted for 73% of total transaction volume

- NBA Top Shot is still the number one dapp in the NFT space generating almost $0.5 billion in Q1 2021

- CryptoPunks garnered 2nd place as the most significant dapp in the NFT sector followed by OpenSea marketplace in 3rd position

- OpenSea was the No. 1 marketplace for secondary markets in Q1, 2021 largely driven by new features such as NFT minting and airdrops

____________________________________________________________________

RECOMMENDED READING: Emerging Markets Like Africa Made Up Only 10% of the DeFi Traffic in February 2021

____________________________________________________________________

Follow us on Twitter for latest posts and updates

Join and interact with our Telegram community

_____________________

Subscribe to the channel below to keep updated on latest news on video:

____________________________________________________________________

Start trading bitcoin today from as low as $10.

Open a Bizlato Bitcoin / Ethereum Trading Account and earn $5 when you sign up!

____________________________________________________________________