The much-awaited Pan-African Payments and Settlement System (PAPSS) was launched in January 2022 at a ceremony in Accra, Ghana, with the promise that it will cut cost of doing cross-border business in Africa.

PAPSS ensures instant or near-instant transfers of funds between originators in one African country and beneficiaries in another.

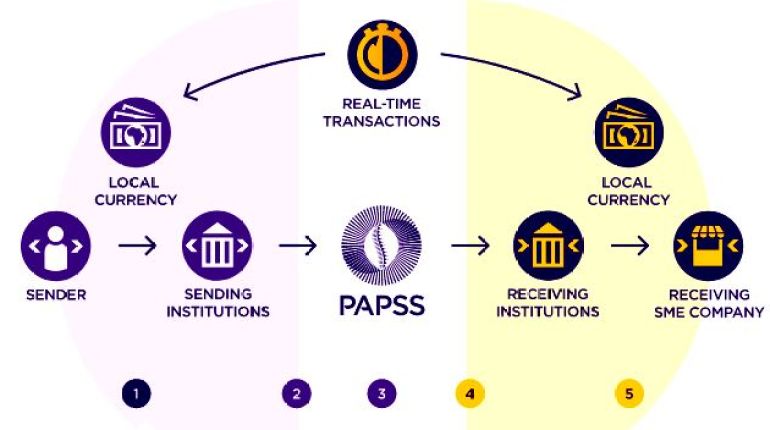

Here are illustrative steps on how it all works out:

- A sender issues a payment instruction in their local currency to their bank or payment service provider

- Payment instruction is sent to the PAPSS system

- PAPSS carries out all necessary validation checks on the payment instruction

- The payment instruction is forwarded to the receiver’s bank or payment service provider

- The receiver’s bank clears the funds to the beneficiary in their local currency

From these steps, we can see that PAPSS is an intermediary between financial services providers like banks. The creators of the system envision a common African market that will benefit a range of participants including governments, banks, businesses, and individuals.

The common market will make it so that a buyer in one African country makes a payment in his or her national currency and the seller in another country receives payment in their local currency.

This is way easier and less costly than changing the Kenyan shilling to the US dollar and then converting the US dollar to the Ghanaian Cedi, as has been the case. This arrangement entailed the funds leaving Africa to be converted before being sent back again to the beneficiary bank – adding days to the transaction time.

The PAPSS launch came after a pilot that included participation from central banks and financial institutions across 6 West African countries.

Other than real-time payments, the system has two key processes – Pre-Funding and Settlemnt.

- Pre-funding requires banks and financial players to provide liquidity to Central Banks to aid transactions

- Settlement is an activity that happens at 11:00 UTC, and involves Central Banks, PAPSS, and AfrieximBank regularizing their accounts

Follow us on Twitter for latest posts and updates

_______________________________________