Dash, a Ghana-based unified payments app, has announced that it has raised $32.8 million in an oversubscribed seed round to facilitate interoperability for digital payments platforms in Africa.

The deal, which ranks among the largest in Africa, will help in its journey of building a Mastercard and Visa sort of intermediary services for mobile payment wallets across Africa.

The round was led by New York-based global private equity and venture capital firm, Insight Venture Partners, with participation from Global Founders Capital and 4DX Ventures. In total, 10 investors joined the $32 million raise.

______________________________________________________________________

SEE ALSO: Top 3 Fintech Sectors to Watch Out for in 2022 Across Africa

______________________________________________________________________

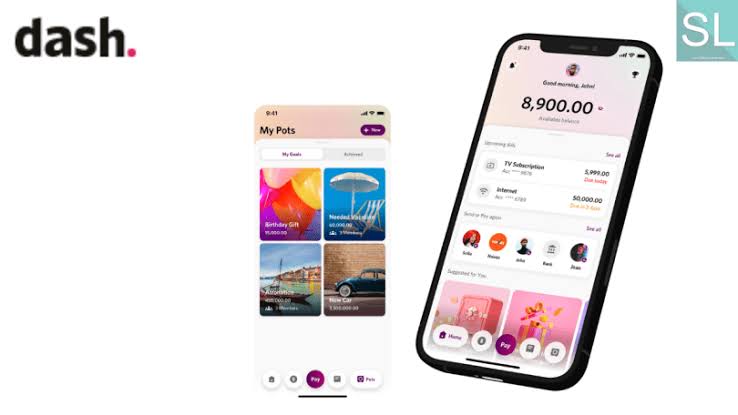

Dash works by routing payments through banks and telcos from different countries and allows users to pay bills, send, and receive money without the headache of currency conversions.

The startup makes revenue from:

- Processing fees

- Savings – interest earned when users save

- FX fees used in cross-border

- Bill payments – commission earned when users pay bills

- Subscription – the Dash+ premium service

Below are some of the growth stats from Dash:

- Processed over $300 million in January 2022

- Transaction volumes up 300% from Q4, 2021

- Processed over $1 billion since launch in 2020

- Boasts over 1 million customers across Ghana, Kenya, and Nigeria

- Userbase was 200, 000 users in October 2021

- Transaction volumes in October 2021 was just $250 million

Dash founder, Prince Baokye Boampong, started the company in 2019 based on the problem that though mobile wallets and payment apps were becoming ubiquitous across the continent, they were not inter-operable – much less for inter-country.

As a result, Dash is building a network where mobile money and traditional banks can rapport and facilitate transactions for consumers and businesses. The service is currently available in:

- Ghana

- Kenya

- Nigeria

The startup said it will use the funds to expand to new markets such as Tanzania and South Africa, get the licenses needed to operate there, build out its team, invest in technology and launch new features.

______________________________________________________________________

RECOMMENDED READING: Tanzanian Fintech, NALA, Raises $10 Million to Expand to 12 African Countries in 2022

______________________________________________________________________

Thank you for your support by helping us create content:

BTC address: 3CW75kjLYu7WpELdaqTv722vbobUswVtxT

ERC20 Address: 0x03139524428e40E31f13909f8D994C915FB91277

SOL address: 9cC65AWFHj848kntcoyiT8av3jiRQEqyTTmBR1GvVUb

____________________________________________________________________

Follow us on Twitter for the latest posts and updates

Join and interact with our Telegram community

_____________________

Subscribe to our YouTube channel below for more updates:

____________________________________________________________________