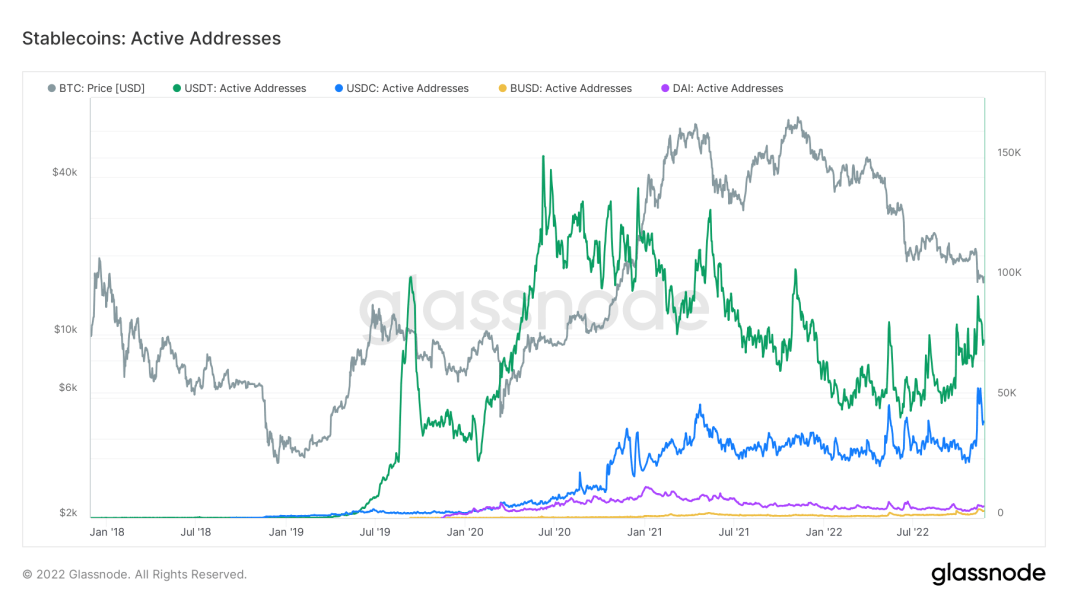

The USDC stablecoin has continued to gain influence over USDT, the largest stablecoin, on-chain data shows. In particular, larger traders appear to prefer moving their funds on USDC.

While the market capitalization of $USDC tokens in circulation is around $44 billion compared to USDT’s $65.42 billion, USDC daily transfer value on the Ethereum blockchain has been consistently higher than USDT throughout 2022.

For example, as of Nov. 22 2022, the USDC daily transfer was around $14 billion compared to USDT’s $5 billion.

The chart above indicates that USDC users engage in relatively higher capital transfers compared to USDT users. This shows that net-worth entities including institutional whales, hedge funds, family offices, and crypto exchanges have a preference for USDC.

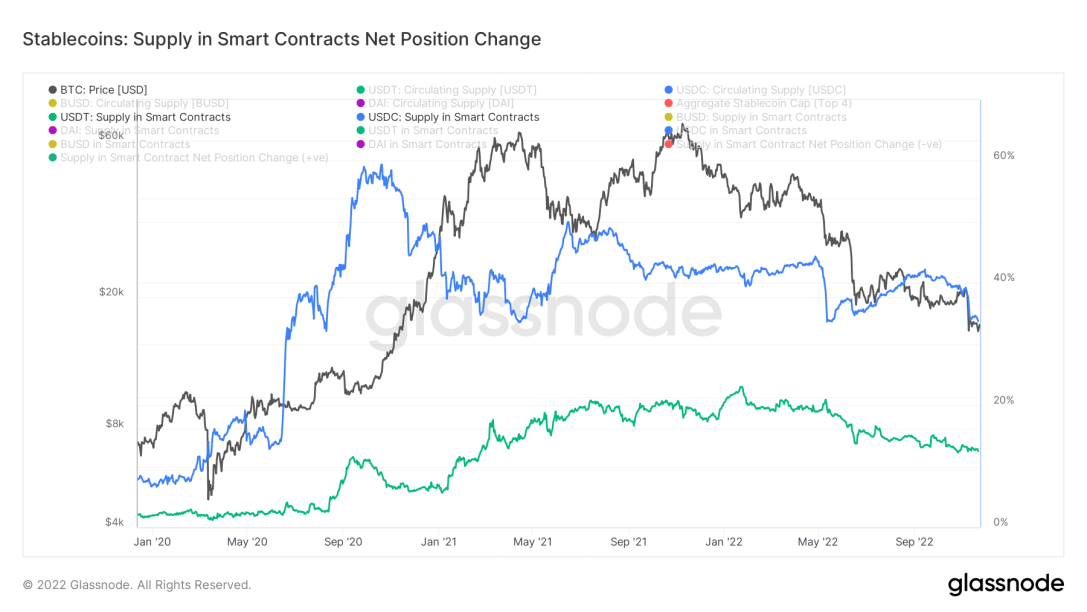

On the same date, USDC also has more supply weight across smart contracts, compared to USDT. USDC made up 33.75% of the total stablecoin supply locked across staking pools while USDT accumulated 12.50%.

This is illustrated again on Glassnode:

USDC appears to be the stablecoin of choice for institutional traders that lock their funds in staking contracts to earn yield. As of November 21 2022, USDC had 40,245 daily active addresses while USDT had 73,000.

While the market capitalization of USDT dropped by nearly $4 billion after the FTX exchange collapse nearly two weeks ago, the USDC market cap rose by nearly $2 billion after Nov. 10 2022 when FTX problems started.

Tether’s loss in market cap is likely related to the stablecoin briefly veering off from its $1 valuation, hitting 96 cents on Nov. 10 2022 after it froze $46 million worth of $USDT tokens associated with FTX.

USDT also dropped below $0.95 cents during the crypto market sell-off in May 2022, coinciding with a spike in USDC’s market cap. This suggests that some investors moved their capital from Tether to USD Coin as the former lost its USD peg.

However, Tether returned to dollar parity within a few days asserting that the tokens in circulation are backed 100% by reserves and pegged 1-to-1 with USD.

__________________________________

Follow us on Twitter for latest posts and updates

Join and interact with our Telegram community

__________________________________

__________________________________