Axis, an Egyptian fintech company, has announced the successful launch of its digital payments platform, AxisPay, intended to streamline payments and businesses of SME’s in the North African powerhouse.

The company obtained a license from the Central Bank of Egypt (CBE) for its mobile wallet allowing it to offer a digital banking solution targeted at small businesses and their employees.

In the last 18 months, the company has raised $8.25 million seed investment co-led by Tiger Global, Sawari Ventures, and Raba with several participants including:

- Firstminute Capital and RaliCap

- Founders of Venmo

- Rho Banking and Cred

- Executives from Revolut and Plaid

In a recent interview, CEO, Jacques Marco, said they’ve been focused over the past two years on three tracks:

- One, licensing (mobile money/wallet issuing and acceptance licenses);

- Two, being deliberate and focused on building the right relationships with the regulator and the local banks, making sure we’re fully licensed and regulated;

- Three, building the whole stack, setting all our integrations end-to-end and passing a certification with the local switch

According to the CEO of Axis, small businesses in Egypt waste approximately 192 hours per year dealing with cash payments to their employees. This includes the time spent on tasks such as sourcing cash, managing payroll, and physically distributing payments.

These small businesses which are estimated to be 8 million in number and contribute to 80% of the nation’s $400 billion+ GDP while employing over 20 million people, also find it cumbersome and expensive to set up bank accounts to streamline their payroll processes.

Small businesses are also usually burdened by manually keeping track of salary advance requests and lending their employees money at the expense of cash flow.

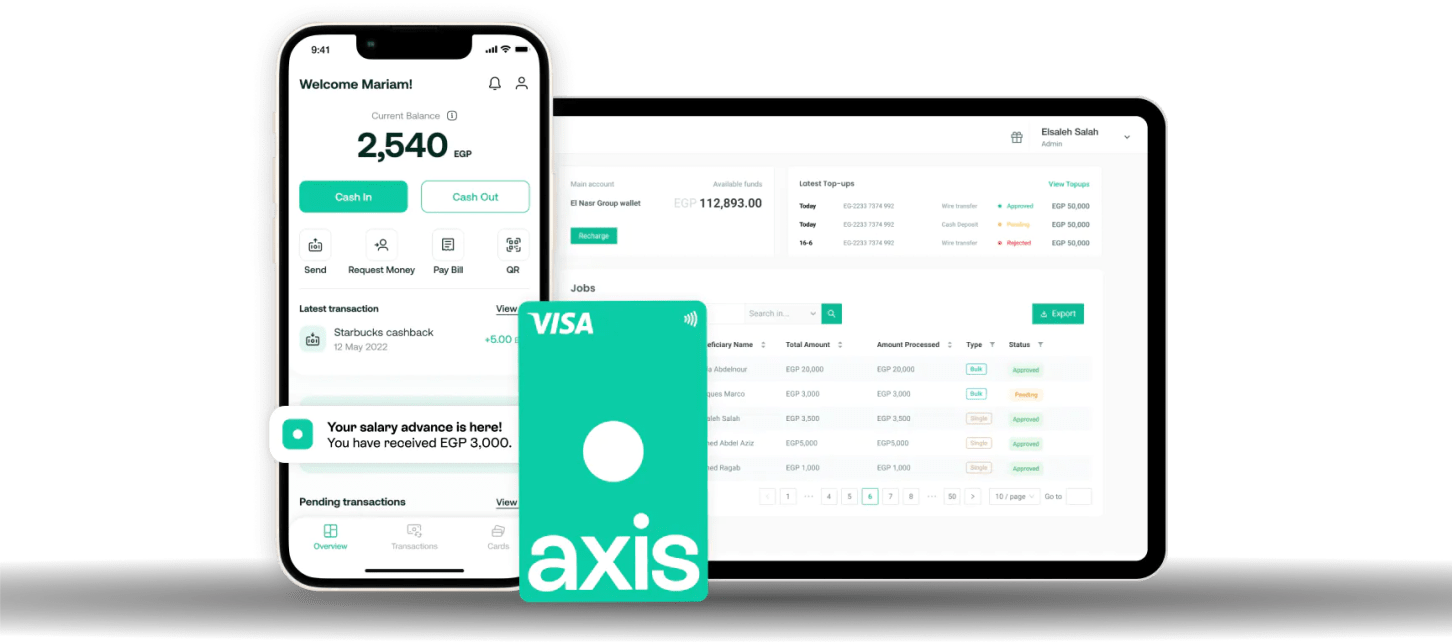

AxisPay offers an alternative solution for small businesses by streamlining their payments to employees and suppliers through mobile wallets. With AxisPay, businesses can make digital payments directly to their employees and suppliers, eliminating the need for cash transactions and providing a more efficient and convenient method of payment.

By utilizing mobile wallets, Axis enables businesses to simplify their payment processes, reduce administrative burdens, and enhance overall financial management.

This includes:

- Sending salaries to employees

- Reimbursing expenses

- Managing expenses

- Providing cashback incentives

- Offering earned wage advances directly to employees’ mobile wallets

In addition, employees using the axisPay wallet gain access to a wide range of financial services, such as:

- Funds transfer

- Bill payment

- Online shopping, and

- Making payments through QR codes

“Think of us like an M-PESA for small businesses in Egypt. We help these small businesses that are heavily cash reliant and pay their employees, suppliers and B2B payments in cash and provide digital payments alternative for them. We’re also solving a consumer pain point and tackling financial inclusion both ways,” said Co-Founder, Nada Abdelnour.

After successfully beta launching its platform, Axis has already onboarded over 100 small businesses across various industries such as food and beverages, retail, tourism, construction, and healthcare. During the stealth phase, the platform also managed to onboard 5,000 employees.

Axis aims to further enhance and refine its offerings as it projects to expand its customer base to 5,000 small businesses and serve approximately 80,000 to 100,000 employees by the end of the year.

Follow us on Twitter for the latest posts and updates

____________________________________________

____________________________________________