According to a recent study, South Africa is at the forefront of the digital transformation of B2B payments in Africa.

Electronic bank transfers are the most favored way to pay vendors in #Africa.

Here is the breakdown:

* Electronic bank transfers – 39%

* Cheques – 18%

* Mobile money – 18%

* Debit/credit cards – 10%

* Cash – 14%https://t.co/S9WwNwNPEW pic.twitter.com/6xZ8HYs4Cj— BitKE (@BitcoinKE) August 9, 2023

The report by business payment platform, Duplo, indicates that electronic transfers accounted for more than 82% of the total $994 billion worth of business-to-business transactions in South Africa.

The report examined survey data collected from 1,218 participants representing various companies in:

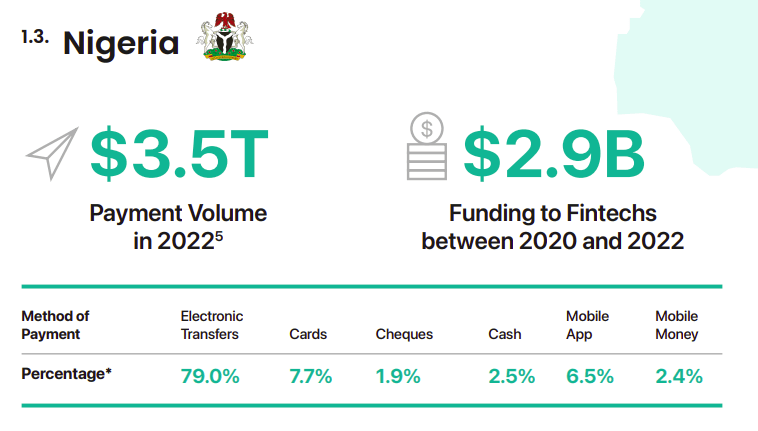

- Nigeria

- Ghana

- South Africa, and

- Kenya

The contributors’ backgrounds encompassed diverse age groups, company sizes, revenues, and sectors.

- In terms of invoice processing speed, South Africa took the lead with a slight margin. Approximately 39.9% of respondents reported that invoices are typically processed within a day or less in South Africa, while Nigeria followed closely at 39.7%.

- Payment automation was most prominent in Kenya, with an impressive 83.4% of respondents indicating that their payment systems were either semi-automated or fully automated. In comparison, Nigeria reported 79.9%, South Africa 71.7%, and Ghana 67.2% in terms of payment automation.

- Mobile money is more prevalent in Kenya (27.2%) and Ghana (30.4%) compared to Nigeria (10.7%) and South Africa (7.6%), likely due to the success of platforms like M-PESA in Kenya and MTN Mobile Money in Ghana, the report notes.

“Despite various challenges, the future of B2B payments in Africa is set for dynamic growth and innovation, signalling a new era of opportunities and expansion for the continent’s business ecosystem. The opportunity to automate accounts payable and receivable and transform other aspects of the B2B payments process offers great potential to reduce payment delays, enhance cash flow and drive growth for businesses across the continent,” said Yele Oyekola, CEO and Co-Founder of Duplo.

“The increased adoption of digital solutions also implies a shift in workplace dynamics and positions finance professionals to add more value to their organisations. We are looking forward to playing a major role in the realisation of these opportunities and the delivery of technology solutions to support growth for businesses in Africa.”

South Africa has been proactively driving the digitization of its payment systems. In March 2023, a collaborative effort between BankServ, a clearing house owned by South African commercial banks, and the South Africa Reserve Bank resulted in the launch of PayShap. This interbank and real-time digital payments service aims to facilitate seamless and instantaneous digital transactions.

Follow us on Twitter for the latest posts and updates

___________________________________________

___________________________________________