In today’s fast-paced and highly competitive financial markets, traders need to arm themselves with powerful tools to stay ahead of the curve.

With the advent of technology and the abundance of financial data, numerous tools have emerged to aid traders in making informed decisions and maximizing their profits. In this article, we will explore five essential financial tools that every trader should have readily available at their fingertips.

1.) Real-Time Market Data Platforms

Access to real-time market data is crucial for traders to track price movements, analyze trends, and make informed trading decisions.

Reliable market data platforms provide a wealth of information, including live quotes, order book depth, trade history, and other relevant metrics. Traders can customize their dashboards, set up alerts for specific price levels or indicators, and utilize advanced charting tools for technical analysis.

Examples of popular market data platforms include:

- Bloomberg Terminal

- Thomson Reuters Eikon

- TradingView

2.) Technical Analysis Software

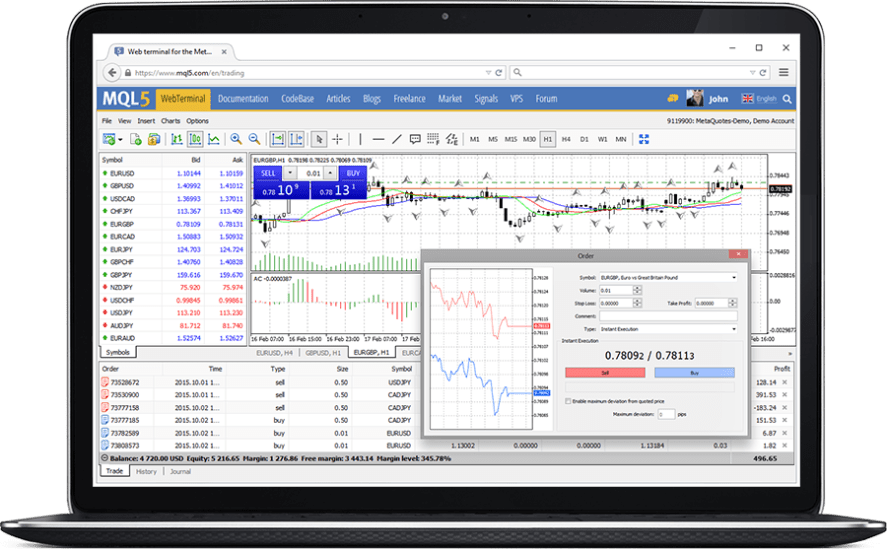

Technical analysis is a key component of trading strategies, and utilizing powerful software can enhance its effectiveness.

These tools provide a wide range of charting features, indicators, and drawing tools that enable traders to identify patterns, support and resistance levels, and key entry and exit points. They also offer backtesting capabilities, allowing traders to assess the performance of their strategies based on historical data.

Widely used technical analysis software includes:

- MetaTrader

- NinjaTrader, and

- TC2000

3.) Risk Management Tools

Managing risk is paramount for traders, as it helps protect their capital and ensures long-term profitability.

Risk management tools provide features such as position sizing calculators, risk-reward analysis, and stop-loss and take-profit order placement. These tools help traders determine the appropriate position size based on their risk tolerance and provide insights into potential gains and losses. They allow traders to set predefined exit points, limiting potential losses and preserving capital.

Examples of popular risk management tools include:

- Riskalyze

- TradeBench

- MyFxBook

4.) Trading Journals

Keeping a trading journal is a practice often overlooked by many traders. However, it is an invaluable tool for analyzing trading performance, identifying strengths and weaknesses, and improving overall profitability.

A trading journal allows traders to document their trades, including entry and exit points, trade rationale, risk management strategies, and emotions experienced during the trade. By regularly reviewing their journal, traders can learn from their past experiences and make necessary adjustments to their trading strategies.

Trading journals can be created using simple spreadsheets or specialized journaling software like:

- Edgewonk or

- Tradervue

5.) Economic Calendar and News Aggregators

Staying informed about economic events, news releases, and market-moving announcements is crucial for traders to help identify potential trading opportunities and adjust strategies accordingly.

Economic calendars provide a comprehensive schedule of upcoming events, including economic indicators, central bank decisions, and corporate earnings reports.

News aggregators collect news from various sources and present them in a consolidated format, enabling traders to stay updated with the latest market developments. These tools help traders identify potential trading opportunities and adjust their strategies accordingly.

Popular economic calendar and news aggregator platforms include:

- Investing.com

- Forex Factory, and

- Benzinga

In today’s dynamic financial markets, having the right tools at your fingertips can significantly enhance your trading prowess and overall profitability.

The five financial tools discussed in this article – real-time market data platforms, technical analysis software, risk management tools, trading journals, and economic calendars and news aggregators – are essential for any trader looking to navigate the markets successfully. By leveraging these tools effectively, traders can make informed decisions, manage risks, and improve their trading performance.

Remember, staying ahead in the markets requires continuous learning and adaptation, so explore and utilize the vast array of financial tools available to empower your trading journey.

________________________________________