A total of 260 companies joined YC for W24, as selected from over 27,000 applications, said the accelerator’s President, Garry Tan.

“With an acceptance rate under 1%, this was one of the most selective cohorts in YC history. Many of the companies in this batch – at least 50% – are building around AI in one form or another,” Tan said.

Actually, the Y Combinator Winter 2024 (W24) cohort has 86 AI startups, according to YC’s official startup directory – nearly double the number from the Winter 2023 batch and close to triple the number from Winter 2021.

Speaking on W24, Y Combinator CEO, Garry Tan, said:

“Why so much AI for YC? It’s simple: YC invests in the best founders in the world, and many of today’s best founders are choosing to build in AI. These founders are constantly discovering new, incredible, practical uses for AI and LLMs that solve problems across industries.

We can now do things with software that weren’t possible just a year or two ago — and we’re still in the very early days! AI is a catalyst unlike anything we’ve seen in a long, long time; what the Internet did for startups in the 90s, and smartphones did in the 2000s, AI is doing once again.”

W24 Verticals:

- 65% in B2B SaaS / Enterprise

- 11% in Consumer

- 10% in Healthcare

- 8% in Fintech

- 4% in Industrials

- 1% in Govtech

- 1% in Edtech

W24 Demographics:

- Asian: 25%

- Black: 4%

- Hispanic: 2%

- Middle Eastern: 5%

- Multi-racial: 10%

- South Asian: 18%

- White: 36%

Just like the previous batch (S23), only 3 startups from Africa:

- Miden

- Triply and

- Cleva

were selected in the batch.

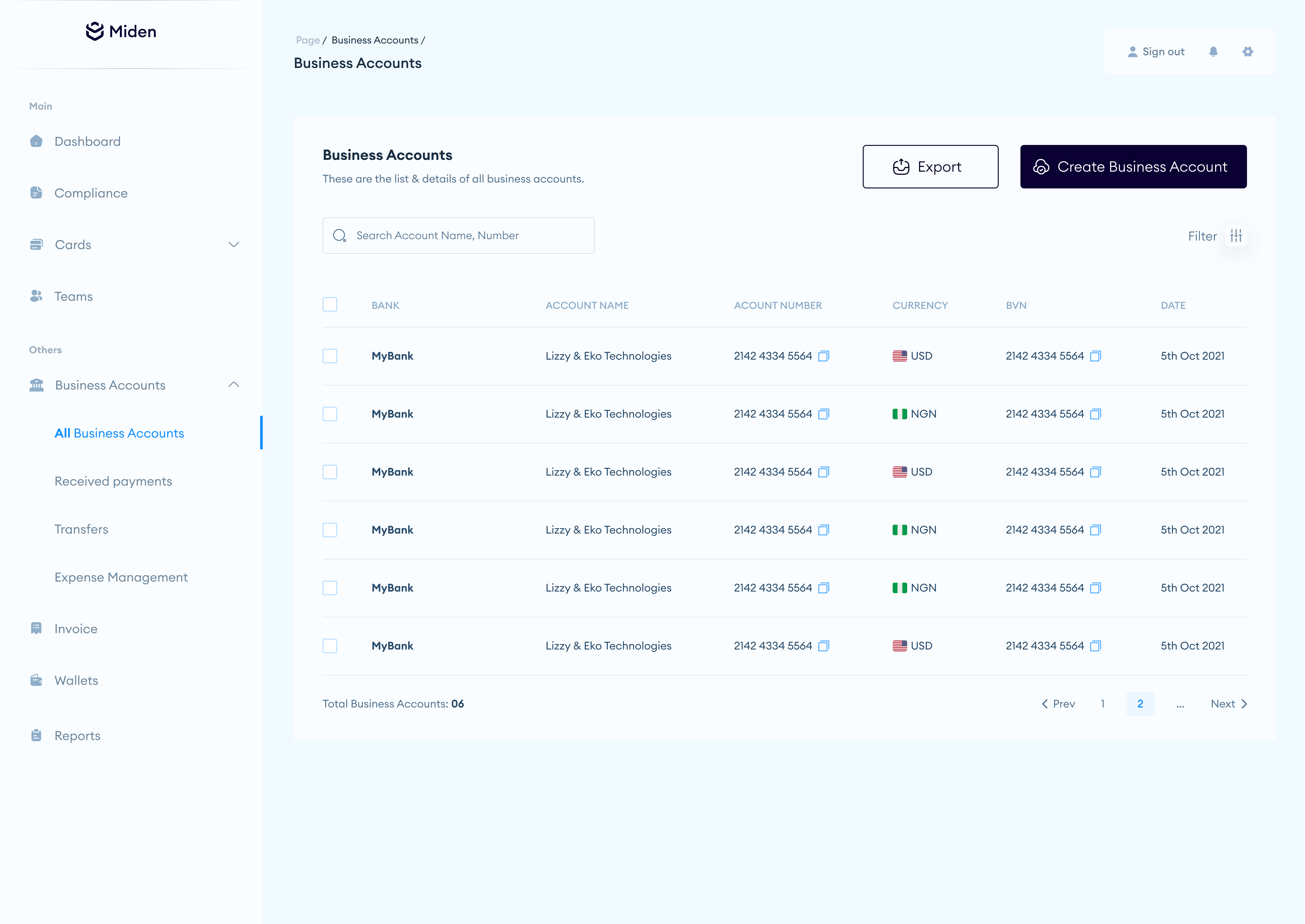

Miden

The Nigerian startup, Miden, is building a modern infrastructure that facilitates the launch of card programs and various financial products for businesses in Sub-Saharan Africa.

Triply

Kenya’s Triply (Formerly Tripitaca) defines itself as the operating system for travel businesses in Africa.

“We eliminate operational chaos by unifying payments, Invoicing, payroll, accounting, operations, and more into a single platform allowing travel businesses to execute and sell more efficiently.”

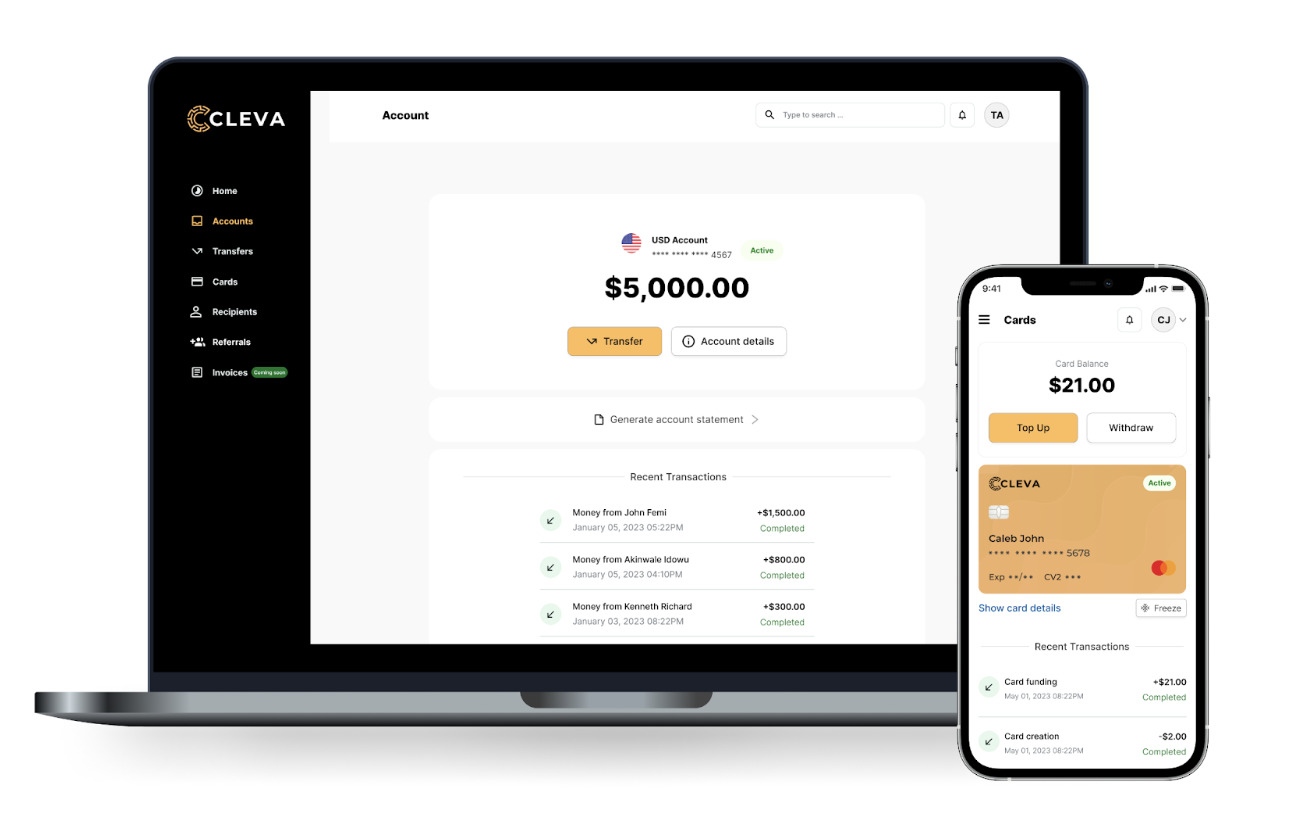

Cleva

Cleva, a Nigeria fintech, enables African freelancers and businesses to receive international payments for their services while protecting themselves from local currency volatility.

“With a Cleva USD account, one can easily receive USD payments from anywhere in the world, spend via a card, pay bills, convert to local currency, and save in USD to hedge against local currency volatility.”

Startups that were selected in the previous batch from Africa include:

African representation reached its peak during the W22 batch with 24 startups from the continent taking part in that batch.

The S22 batch featured only seven African startups.

Kenya’s

Patika is Latest Entrant into Y-Combinator [YCS22]

Patika, which describes itself as a digital loans book, enables small businesses in Africa to:

* Track customer debt

* Facilitate the repayments, and

* Manage their cash flowhttps://t.co/orCB6xHtf5 @PatikaAfrica— BitKE (@BitcoinKE) June 16, 2022

________________________________________