Open interest holds significant importance in financial markets, particularly in futures and options trading. It signifies the overall number of active contracts for a specific financial instrument at any given point in time.

A futures contract entails an agreement between two parties to buy or sell the underlying asset at a predetermined price on or before a specified future date.

Open interest is the number of contracts that have been opened but not exercised, expired, or otherwise closed. Volume is the number of contracts that have been bought and sold over a specific period. Both are used in technical analysis to help traders make decisions.

Open interest is calculated by summing up the number of long (buy) contracts and short (sell) contracts. For every buyer, there is a seller, so the total open interest is the same for both sides of the trade.

Importance of Open Interest

Open interest is a crucial indicator of market sentiment. A rising open interest suggests a growing market, indicating new money entering the market and potential bullish trends. Conversely, a decreasing open interest may signal waning interest or a potential reversal.

Higher open interest generally implies greater liquidity in the market. This liquidity is essential for smooth trading operations, reducing the risk of slippage and ensuring that traders can easily enter or exit positions.

Open interest can change throughout the trading day as new contracts are created or existing ones are closed through offsetting trades. Understanding these changes can provide insights into the evolving market dynamics.

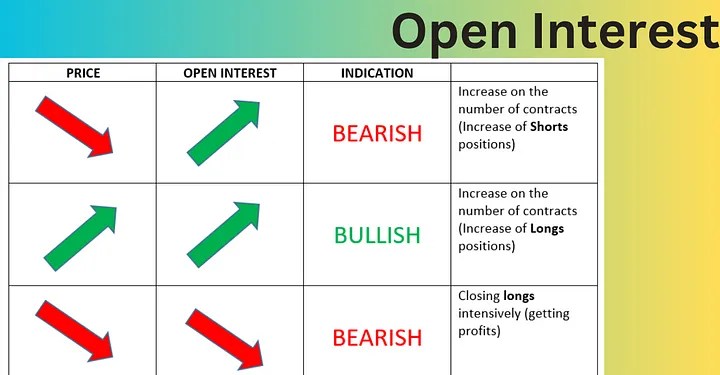

- Bullish Sign: A rising open interest alongside an upward price trend may indicate increasing confidence in the market. Traders are actively participating and holding positions, suggesting potential further price appreciation

- Bearish Sign: A declining open interest coupled with a falling price may signal a weakening market sentiment. Traders are closing positions, indicating a lack of confidence in the current trend

But it is not that simple, analyzing changes in open interest is crucial for identifying potential trend reversals. For instance, a discrepancy where prices increase but open interest declines might indicate a weakening of bullish support, potentially signaling an impending reversal.

Open interest is a dynamic concept, influenced by the establishment of new positions or the offsetting of existing ones. It’s essential to consider both buy and sell transactions in open interest calculations as each trade involves two parties creating both a long and a short position.

For example, if Trader A goes long (buys) and Trader B goes short (sells) on a single Bitcoin (BTC) futures contract, the open interest increases by one contract. However, if Trader C later buys one Bitcoin futures contract from Trader B, the open interest remains unchanged as the contract simply transfers from one party to another.

Nevertheless, the open interest increases by one when Trader D enters the market and buys an additional Bitcoin futures contract.

Trading Strategies that Rely on Open Interest

Open interest analysis serves as the cornerstone for various trading strategies providing traders with valuable insights into market sentiment and potential trends.

One commonly used approach involves leveraging open interest to either validate or challenge existing price patterns. If prices are on the rise alongside an increase in open interest, it suggests that the trend is likely to persist. Conversely, a decrease in open interest while prices are rising may indicate weakening support for the upward trend.

Another tactic involves monitoring changes in open interest alongside price movements. Divergences, where open interest moves in the opposite direction to prices, can signal a potential trend reversal. For instance, if prices are increasing while open interest is decreasing, it might suggest that the current upward trend is losing momentum.

However open interest is just one yardstick used to analyze the market. To enhance decision-making, traders often combine open interest analysis with other technical indicators.

By integrating open-interest research with tools like momentum indicators or moving averages, traders can develop a more comprehensive understanding of market conditions, aiding them in identifying optimal trading opportunities.

Follow us on Twitter for the latest posts and updates

Join and interact with our Telegram community

__________________________________________

__________________________________________