Stablecoins are increasingly finding adoption for non-crypto activities, in contrast to their original use-case as a bridge to crypto-assets.

According to one survey of 2,500 active stablecoin users in India, Indonesia, Nigeria, Turkey, and Brazil:

- 47% of participants said they primarily use stablecoins to get dollar-access

- 43% said to get better currency conversion rates, and

- 32% said to send money internationally

The survey indicates that consumers are exploring the use of stablecoins for purposes beyond crypto trading, such as cross-border remittances and payroll, said Head of Crypto at VISA, Cuy Sheffield.

Almost 10% of Payroll Withdrawals from African Contracts are in Crypto, Says Latest Report by @deel https://t.co/u4nDXY5ZiN

— BitKE (@BitcoinKE) March 3, 2022

According to Sheffield, when asked if they had ever used stablecoins for the following activities:

- 69% have converted local currency to a stablecoin

- 39% have used stablecoins to pay for a good or service

- 39% have used stablecoins for a cross-border payment, and

- 23% have used stablecoins to receive or pay a salary

The survey, done by VISA and @YouGov, also suggests that stablecoin usage for non-crypto activities will continue to grow, as:

- 57% of respondents report an increase in stablecoin usage in the past year, and

- 72% believe their usage will increase in the future

REPORT | Nigeria Dominates Emerging Markets Globally in Stablecoin Use, Says a September 2024 YouGuv Survey

The survey also determined that Nigerian users have the highest stablecoin affinity among the countriessurveyed – by far.

Nigerian users transact most frequently,… pic.twitter.com/fRFCXjuCZG

— BitKE (@BitcoinKE) September 16, 2024

Demographic results from the survey show that usage for all non-crypto use cases is highest among 18 -24-year-olds, and 34% of them indicated that they convert local fiat to stablecoins on a weekly basis.

VISA, which in May 2024 said that bots accounted for 90% of reported stablecoin transactions, announced an improvement to its methodology for measuring stablecoin transactions.

JUST IN: New report from Visa and data platform Allium Labs shows that well over 90% of stablecoin transaction volumes ($2.2T) aren’t coming from real users. pic.twitter.com/yvmNotq6Rg

— Jacob King (@JacobKinge) May 12, 2024

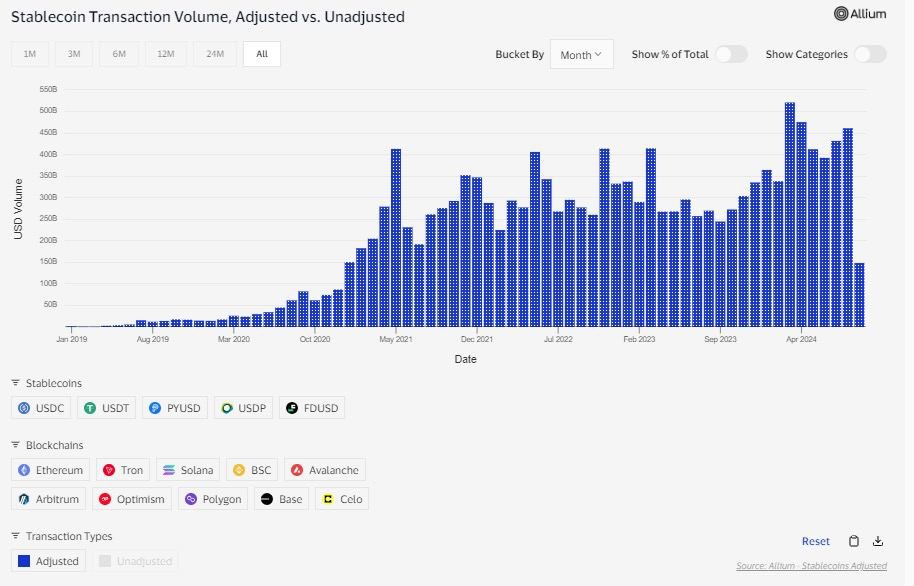

That month, VISA collaborated with Allium Labs on a dashboard developed to filter out transactions initiated by bots and large-scale traders, focusing solely on transactions made by genuine individuals. Based on that methodology, out of the approximately $2.2 trillion in total transactions recorded in April 2024, VISA said that only $149 billion stemmed from ‘organic payments activity.’

But VISA now says it has collaborated with @CastleIslandVC, @AlliumLabs, and @Artemis_xyz on an updated methodology, which utilizes wallet address labeling techniques to attribute transactions to specific entities.

“Using this methodology, since 2019, adjusted stablecoin volume has grown on average, 225% each year, throughout market cycles,” said Sheffield.

“We welcome feedback on this approach and hope it can become a standard for stablecoin data analysis.”

Follow us on X for the latest posts and updates

Join and interact with our Telegram community

_________________________________________

_________________________________________