Ivory Coast fintech startup, Djamo, has secured $17 million in equity funding to support the expansion of its mobile banking services across Francophone Africa.

The round was led by:

with participation from:

- The SANAD Fund for MSMEs

- Partech

- OikoCredit

- Enza Capital, and

- Y Combinator

FUNDING | Janngo Capital Announces Close of Fund 2 at $78 Million to Invest in African Tech

The firm markets itself as a ‘gender-equal’ investor and women-led startups make up 56% of Janngo Capital’s portfolio across both funds.https://t.co/24xiEAw4bs pic.twitter.com/A2Cq0jS2Di

— BitKE (@BitcoinKE) November 2, 2024

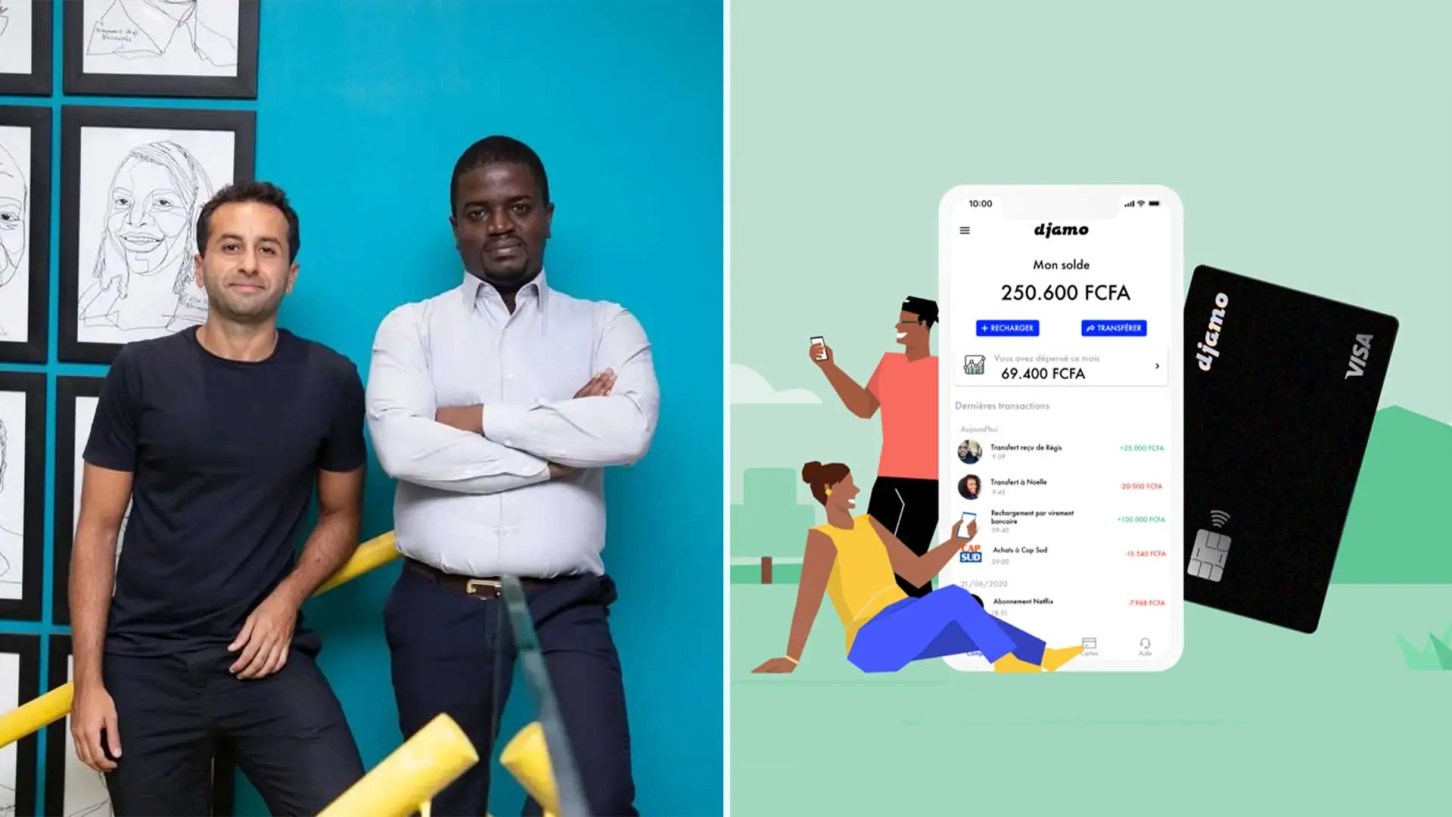

Founded in 2021 by Regis Bamba and Hassan Bourgi, Djamo offers digital-first financial solutions tailored for consumers and small businesses in a region where fewer than 25% of adults have access to formal banking services. The company has quickly expanded its operations in Côte d’Ivoire and Senegal, surpassing 1 million customers and serving 10,000 SMEs.

Djamo’s founders say the company has grown revenue 5x since 2022 and processed more than $4.5 billion in transactions since launch.

The startup has also grown beyond its initial offerings of cards and peer-to-peer transfers. The Ivorian fintech now provides savings vaults, investment products – made possible through the region’s first fintech-issued brokerage license and salary-linked bank accounts, which Co-Founder, Hassan Bourgi, views as key to increasing customer engagement.

“This investment is a major step toward our vision of building one of the most iconic financial services platforms in Francophone Africa,” said CEO and Co-Founder, Hassan Bourgi.

“Millions remain underserved by banks or confined to mobile money ecosystems without real wealth-building opportunities. We are committed to changing that.”

Janngo Capital, which led the round, emphasized Djamo’s role in advancing financial inclusion noting that 60% of its users were previously unbanked and one-third are women.

“Djamo is not only bridging the gender gap but also unlocking economic opportunities at scale,” said Fatoumata Bâ, Founder and Executive Chair at Janngo.

The equity round, the largest ever for an Ivorian startup as reported by BitKE, surpasses Djamo’s $14 million Series A in 2022 and highlights ongoing investor confidence in its mission to make banking accessible and affordable.

Ivory Coast

Fintech, Djamo, Raises $14 Million to Expand Across Francophone Africa – Currently Has Over 500K Users

Djamo was the first startup from its country to get accepted into YCombinator.https://t.co/ucBE1NTWV6 @djamoci

— BitKE (@BitcoinKE) December 19, 2022

With the new funding, Djamo plans to enhance its platform by introducing improved features for spending, saving, investing, and borrowing while accelerating its efforts to deliver seamless and affordable financial services to underserved communities across West Africa.

Join and interact with our Telegram community

__________________________________

__________________________________