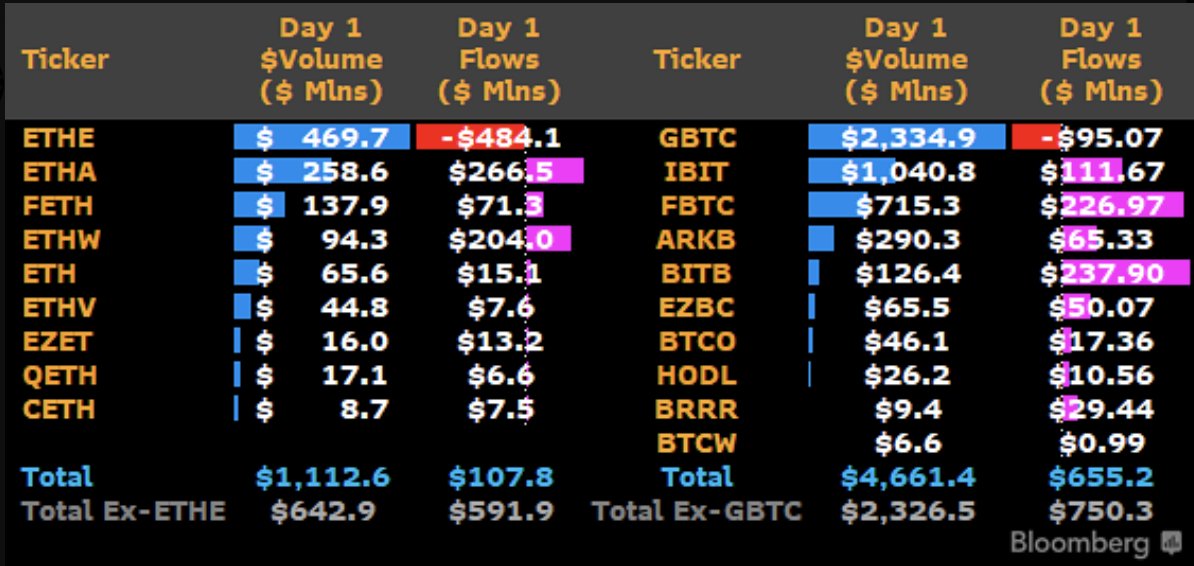

The nine United States Ether Exchange-Traded Funds (ETFs) saw about $1.08 billion in cumulative trading volume on their first day, 23% of what the spot Bitcoin ETFs had on their first day.

The ETFs, listed on July 23 2024, posted net inflows of $106.6 million on the first day despite Grayscale’s freshly-converted Ethereum Trust experiencing $484.1 million in net outflows, the only fund with outflows.

- BlackRock’s iShares Ethereum Trust ETF (ETHA) led with $266.5 million of inflows, followed closely by

- The Bitwise Ethereum ETF (ETHW) with $204 million in net inflows

- The Fidelity Ethereum Fund ETF (FETH) came in third with $71.3 million

- Grayscale’s Ethereum Mini Trust, a spinoff product launched by the asset manager with lower fees, generated $15.2 million in new inflows

- Franklin Templeton’s Franklin Ethereum ETF (EZET) netted $13.2 million, while

- 21Shares’ Core Ethereum ETF (CETH) saw $7.4 million in inflows

Bloomberg Intelligence’s James Seyffart said the ETF launch ‘pretty much’ met his expectations.

“[If] we compare it to a standard ETF launch, it was a smashing success,” Seyffart said.

Juan Luan, senior Investment Strategist at Bitwise Invest, said the demand for ETH surpassed expectations on day one.

“Total ETH flows ($108M) were 16% of BTC flows ($655M), but 79% if you exclude the outflows from ETHE ($484M)/GBTC ($95M) conversions. ETHE outflows likely larger because it was already trading at NAV on conversion, while GBTC was still at discount,” he said.

That said, cryptocurrency market data provider, Kaiko, reported that despite spot Ethereum ETFs attracting more than $1 billion in trade volume on their first day, spot ETH trading volume on centralized exchanges barely moved.

The price of $ETH even dropped further on July 24 2024. The second largest cryptocurrency is trading for $3,161 at the time of publication, down 8% in the last 24 hours and 7.4% in the last seven days, according to CoinGecko.

By comparison, the U.S. stock market experienced a significant downturn, marking its worst one-day performance since late 2022. The S&P 500 fell by 2.3%, and the Nasdaq Composite saw a steeper decline of 3.64%. This sell-off was primarily driven by disappointing quarterly results from major tech companies, including Alphabet and Tesla.

JUST IN: Over $1.1 trillion was wiped out from the US stock market today. pic.twitter.com/xVtxWeKiRQ

— Watcher.Guru (@WatcherGuru) July 24, 2024

Follow us on Twitter for the latest posts and updates

Join and interact with our Telegram community

________________________________________

________________________________________

Disclaimer: The Content on this website is for informational purposes only. You should not construe any such information or other material as legal, tax, investment, financial, or other advice.