The number of Bitcoin wallet addresses containing at least one whole Bitcoin ($BTC) or more has crossed the one million mark according to a recent analysis by Glassnode.

During the significant price decline of Bitcoin, which saw a decrease of over 65% throughout the previous year, there was a notable increase in the number of wallet addresses holding one Bitcoin or more.

Specific market events such as the FTX collapse, and subsequent bankruptcy filing in November 2023, might have triggered panic selling and motivated investors to consolidate their holdings into fewer addresses.

In total, a whopping 190,000 or so ‘wholecoiners’ were added from early February 2022 as the price of Bitcoin fell from its November 2021 highs. According to Glassnode Co-Founder, Negentropic, the best time to buy Bitcoin is when there’s ‘blood in the streets.’

"Buy when there is Blood in the streets."

$25.8k still remains a possibility, as indicated by the options market

Confident in our mid-term outlook of $35k as external pressures subside.

Market pricing Fed pause in June, no rate cut – optimal for the run to $35k for… pic.twitter.com/xBnIyHK5A0

— 𝗡𝗲𝗴𝗲𝗻𝘁𝗿𝗼𝗽𝗶𝗰 (@Negentropic_) May 12, 2023

It is important to note that many cryptocurrency investors utilize multiple Bitcoin addresses. Additionally, cryptocurrency exchanges and investment firms often hold significant amounts of Bitcoin and may use multiple addresses to manage their customers’ funds securely and to segregate different types of assets.

These various addresses contribute to the overall number of Bitcoin wallet addresses holding one Bitcoin or more, so the number of addresses does not directly correlate to the number of unique individuals or entities holding Bitcoin.

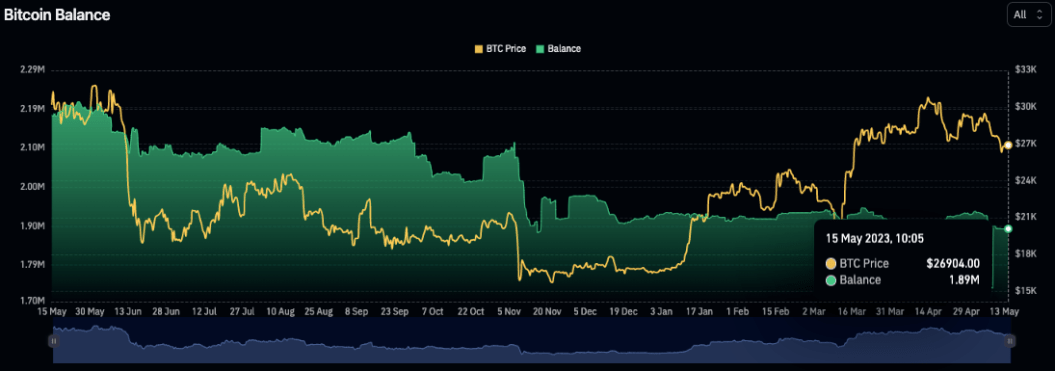

More analysis gleaned from CoinGlass shows that, out of the roughly 19 million Bitcoin currently in circulation, 1.89 million of these BTC – worth $50.7 billion – are held on major centralized exchanges such as Binance and Coinbase.

Finally, according to estimates from Glassnode, a significant amount of Bitcoin, approximately 3 million BTC, is considered ‘lost forever.’

This estimation takes into account various factors, such as:

- BTC sent to ‘burn addresses’

- Wallets with lost keys, and

- Large accounts that have remained inactive for an extended period, including those that have not been accessed for over a decade

These lost Bitcoins, which amount to approximately 17% of the total circulating supply, are no longer accessible or recoverable by their owners. The value of these lost Bitcoins, based on current prices, is estimated to be around $80.4 billion.

Follow us on Twitter for the latest posts and updates

_______________________________________

_______________________________________