In the ever-evolving world of cryptocurrencies, traders and investors often seek innovative strategies to maximize their profits. Among the various approaches, arbitrage stands out as a potentially rewarding technique.

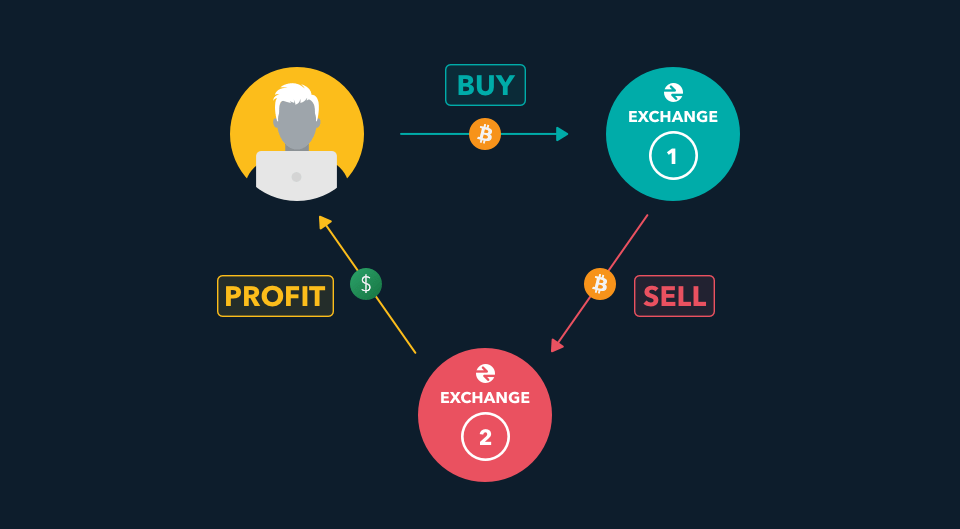

Arbitrage, in its essence, involves exploiting temporary price differences of an asset between two or more markets to profit from the imbalance. By taking advantage of price discrepancies across different cryptocurrency exchanges or markets, arbitrageurs can generate profits with minimal risk.

In the context of cryptocurrencies, these price discrepancies arise due to factors such as varying supply and demand dynamics, differences in trading volume and liquidity, geographical disparities, and latency issues in price updates.

Types of Cryptocurrency Arbitrage

Before diving into the identification process, let’s explore three primary types of cryptocurrency arbitrage:

- Simple Arbitrage: This type of arbitrage involves buying a cryptocurrency at a lower price on one exchange and selling it at a higher price on another exchange. The process capitalizes on price differences between the exchanges

- Triangular Arbitrage: Triangular arbitrage involves taking advantage of price differences between three different cryptocurrencies. Traders execute a series of trades across multiple exchanges to profit from the relative value changes of the currencies involved

- Statistical Arbitrage: Statistical arbitrage is a more complex strategy that relies on quantitative models and statistical analysis. Traders identify patterns and statistical anomalies in price movements to predict and capitalize on future price discrepancies

Identifying Arbitrage Opportunities

To identify and seize arbitrage opportunities effectively, consider the following detailed steps:

- Research and Monitor Exchanges: Begin by conducting thorough research on different cryptocurrency exchanges. Understand their trading volumes, liquidity, fees, and supported currencies. Popular exchanges like Binance, Coinbase, or Kraken are often a good starting point due to their large user bases and extensive trading options. Keep a list of exchanges that interest you.

- Track Price Discrepancies: Utilize cryptocurrency price tracking websites or trading platforms that offer real-time price data. Compare prices of the same cryptocurrency across different exchanges simultaneously. Look for significant price discrepancies, which may present potential arbitrage opportunities. Remember to consider transaction fees, withdrawal fees, and any other relevant costs associated with each exchange.

- Analyze Market Depth and Liquidity: Market depth refers to the volume of buy and sell orders at different price levels. It is crucial to consider the liquidity of the markets you are analyzing. Thinly-traded markets can be more prone to price manipulation or illiquidity making it harder to execute profitable arbitrage trades. Focus on exchanges with substantial liquidity to increase your chances of success.

- Consider Transaction Speed and Fees: Arbitrage opportunities can vanish quickly, so transaction speed is paramount. Identify exchanges that offer fast and reliable transaction processing times. Additionally, be mindful of transaction fees, as they can eat into your potential profits. Some exchanges may have high fees, while others offer discounted rates for high-volume traders. Balance transaction speed and fees when evaluating opportunities.

- Assess Regulatory and Security Factors: Different jurisdictions have varying regulations regarding cryptocurrency trading. Ensure you are aware of the legal framework surrounding crypto trading in your region and the regions where your chosen exchanges are based. Furthermore, prioritize exchanges with robust security measures to safeguard your funds during transactions.

- Execute Swiftly and Accurately: Once you identify a promising arbitrage opportunity, act swiftly. Remember that market conditions can change rapidly, and delays may lead to missed opportunities. Ensure you have accounts set up on the relevant exchanges, have funds available for trading, and understand the process for executing trades on each platform. Accuracy and attention to detail are crucial during this stage.

- Monitor and Review Results: After executing an arbitrage trade, carefully monitor the markets to ensure the opportunity is still profitable. Keep track of your trading activities and measure the success and effectiveness of each arbitrage opportunity. This data will help refine your strategies and improve future decision-making.

Identifying and capitalizing on arbitrage opportunities in the cryptocurrency space requires diligent research, careful analysis, and swift execution. By tracking price discrepancies across exchanges, considering market depth and liquidity, evaluating transaction speed and fees, and maintaining an understanding of regulatory and security factors, you can increase your chances of successfully identifying and benefiting from arbitrage opportunities.

Remember, thorough preparation and continuous learning are key to maximizing your potential profits in the dynamic world of cryptocurrency arbitrage.

Follow us on Twitter for the latest posts and updates

_________________________________________________

_________________________________________________