A new survey by global auditing company, Deloitte, has shown that leading executives in the global financial services industry (FSI) believe blockchains have gone mainstream.

In a departure from previous versions that focused on blockchain’s utility and general adoption, the 2021 Global Blockchain Survey looks at how digital assets — enabled by blockchain technologies — are disrupting the financial services industry globally.

___________________________________________________________________

___________________________________________________________________

According to Linda Pawczuk, Principal, Deloitte Consulting:

“The Deloitte 2021 ‘Global Blockchain Survey’ shows that the foundation of banking has been fundamentally outlived and financial services industry players must redefine themselves and find innovative ways to create economic growth in the future of money.”

– Deloitte Consulting

Key Findings from the Survey:

- 81% of the financial services industry (FSI) executives polled indicated that blockchain technology is ‘broadly scalable’ and has achieved mainstream adoption

- Nearly 80% of overall respondents say that digital assets will be very / somewhat important to their respective industries in the next 24 months

- 73% of respondents fear their organizations will lose competitive advantage if they fail to adopt blockchain and digital assets

- 76% believe that the end of physical money is near, with digital assets replacing fiat currencies in the next 5 to 10 years

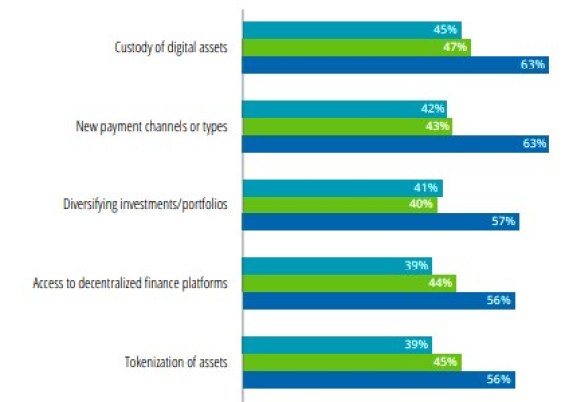

- Survey repsondents Identify with the following potential use cases – Custody (45%), new payment channels (42%) and diversification of investments / portfolios (41%)

- 43% of FSI respondents say that new payment options represent a ‘very important’ role for digital assets in their organizations

- Approximately 6 in 10 overall survey respondents – and 7 in 10 FSI pioneers – identified regulatory barriers among the biggest obstacle to acceptance of digital assets

- Nearly 70% of overall survey respondents identified the regulation of data security as needing the greatest modification

- 71% indicating cybersecurity among the biggest obstacles to acceptance

The survey was run between March – April 2021, with a sample of 1,280 senior executives and practitioners drawn from:

- Brazil

- China

- Germany

- Hong Kong

- Japan

- Singapore

- South Africa

- United Arab Emirates

- United Kingdom (U.K.)

- United States (U.S.)

The survey also broke respondents into 3 groups:

- Overall: All survey participants across select industries, including FSI government and public services, technology, media, telecommunications, life sciences, and health care

- FSI overall: Senior executives in FSI

- FSI pioneers: Senior executives that have identified blockchain and digital assets as a top five strategic priority and already deployed blockchain solutions into production or integrated digital assets into their core business activities

The survey concludes that the financial services industry must accelerate toward product modernization and distribution to achieve economic growth.

________________________

Read / Download the survey here.

___________________________________________________________________

RECOMMENDED READING: Inside China’s Plans to Lead in Blockchain Technologies by 2025

___________________________________________________________________

Thank you for your support by helping us create content:

BTC address: 3CW75kjLYu7WpELdaqTv722vbobUswVtxT

____________________________________________________________________

Follow us on Twitter for latest posts and updates

Join and interact with our Telegram community

_____________________

Subscribe to the channel below to keep updated on latest news on video:

___________________________________________________________________