The long-awaited ‘2021 Geography Cryptocurrency Report‘ by Chainalysis is out and shows worldwide crypto adoption was up over 880% with P2P platforms driving crypto usage in emerging markets.

Out of the top 20 global markets in crypto adoption, 6 are from Africa.

According to the report, lobal adoption of crypto has grown by:

- Over 2,300% since Q3, 2019

- Over 881% since 2020

- Only 3% of global crypto value came from Africa

While adoption has largely been driven by institutional investment in developed markets, the report highlights the drivers of adoption in emerging markets like Africa as:

- To preserve savings in the face of currency devaluation

- Send and receive remittances

- Carry out business transactions, especially cross-border

___________________________________________________________________

___________________________________________________________________

The report also notes that P2P platforms have a greater share of total transations volume made up of smaller, retail-sized payments under $10, 000 worth of cryptos.

The report also notes that DeFi is one of the fastest-growing and most innovative sectors of the cryptocurrency economy. DeFi growth is highest in middle to high-income countries or markets with already-developed crypto markets, and in particular, strong professional and institutional markets such as:

- United States

- China

- Vietnam

- the UK

From the top 20 DeFi adoption list, Togo was the only African country on the list.

Looking at DeFi traffic by country, central, north and western European countries lead followed by North America. Africa contributes the least amount of traffic to DeFi platforms.

The data shows that large transactions make up a much bigger share of DeFi activity, suggesting that DeFi is disproportionately popular for bigger investors compared to cryptocurrency as a whole.

Large institutional transactions, meaning those above $10 million in USD, accounted for over 60% of DeFi transactions in Q2 2021, compared to under 50% for all cryptocurrency transactions. Professional, large retail, and small retail-sized transactions also accounted for a bigger percentage of all cryptocurrency activity compared to DeFi activity in that same time period.

From the report it is clear that countries that have historically accounted for the most professional and institutional-sized cryptocurrency transactions are also driving the most DeFi activity.

While emerging markets like Africa are driving crypto adoption out of necessity, DeFi adoption, on the other hand, is primarily powered by experienced crypto tranders and investors looking for new sources of alpha in innovative new platforms. This remains true even when you favor grassroots adoption.

Below is a breakdown of crypto activity by region:

- North America accounted for 18% of global cryptocurrency value at over $756 billion – the second-largest crypto economy and world’s strongest markets for DeFi

- The United States ranks first on the DeFi Adoption Index and plays a huge role in North Aerica’s strong crypto growth

- North America saw over 1,000% in crypto transaction volumes largely driven by DeFi popularity

- The United States leads the way in retail-sized DeFi transactions as well at below $10,000 in value

- Overall, nine of the 25 biggest cryptocurrency services by transaction volume in North America are now DeFi protocols, with Uniswap, dydx, and Compound being the most popular

- Ransomware is one of the fastest-growing forms of cryptocurrency-based crime and perhaps the most dangerous in its real-world implications given the types of organizations that are frequently attacked

- Latin America accounted for 9% of global cryptocurrency value at over $353 billion – the 6th largest crypto economy with strong grassroots adoption

- Central, Northern, and Western Europe accounted for 25% of global cryptocurrency value at over $1 trillion – the biggest crypto economy in the world largely driven by DeFi adoption

- Large institutional crypto transaction value grew from $1.4 billion in July 2020 to $46.3 billion in June 2021 showing the huge impact DeFi has had in the region

- DeFi protocols represent three to four of the top five services in most months, with Uniswap, Instadapp, and dydx making frequent appearances. Binance and Coinbase, meanwhile, remain the most popular centralized exchanges

- The UK, France, Germany, Netherlands, and Spain are the top 5 markets by crypto value in Europe

- The United Kingdom leads by a wide margin at $170 billion, 49% of which is from value sent to DeFi protocols

- Nearly half of all crypto activity in Albania is DeFi

- Stablecoin activity in most European countries is between 25 – 30% of all transaction volumes

- 39% of all activity in Monaco is stablecoin usage

- Bitcoin makes up 27% of the UK’s crypto transaction value while Ethereum and wETH makes up 40%

- Bitcoin makes up 28% of all transaction volues in Germany with Ethereum and wETH making up 36%

- Bitcoin makes up just 20% of all transaction volue while Ethereum and wETH makes up 45% of activity

- Eastern Europe accounted for 10% of global cryptocurrency value at over $422 billion – 929% increase YoY

- Capital flight is one of the possible reasons why crypto adoption in Eastern Europe is high due to distrust in governments especially in former Soviet States

- International transactions make up a larger share of Eastern Europe’s cryptocurrency transaction volume than for comparably sized regions. Just 14% of Eastern Europe’s transaction volume is estimated to take place between two Eastern Europe addresses, versus 22% for the global average across all regions, 26% for North America and Western Europe, and 27% for Eastern Asia. Capital flight could account for some of the difference

- An estimated 86% of all cryptocurrency sent from Russia-based addresses and 87% of cryptocurrency sent from Ukraine-based addresses travels to addresses based in another country. Turkey is the only country that sends a bigger share of its cryptocurrency abroad

- Addresses based in Eastern Europe have the second-highest rate of exposure to illicit addresses behind only Africa

- Eastern Europe is the only region with a total transaction volume of $400 million or more for which illicit activity makes up more than 0.5% of total cryptocurrency value sent and received

- Ukraine leads in the number of visits to cryptocurrency scam sites globally

- Central and Southern Asia accounted for 14% of global cryptocurrency value at over $572 billion – 706% increase YoY

- Starting around May 2020, DeFi activity as a share of all transaction volume skyrockets, reaching above 50% by February. This activity is primarily driven by Uniswap, Instadapp, and dydx, with significant activity on Compound, Curve, AAVE, and 1inch as well

- Professional-sized transfers between $10,000 and $1 million worth of cryptocurrency make up the largest share of transaction volume in Central and Southern Asia

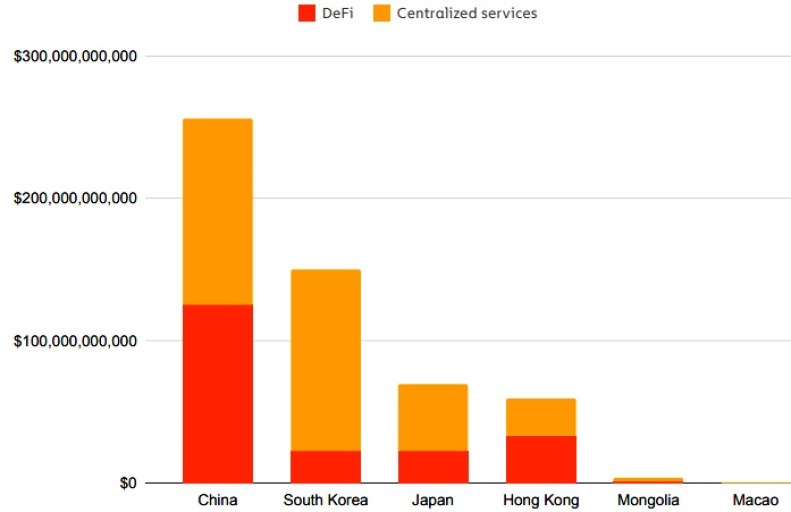

- Eastern Asia accounted for 14% of global cryptocurrency value at over $591 billion – a 452% growth YoY

- China is the biggest market in the region by far with $256 billion in cryptocurrency received between July 2020 and June 2021, 49% of which went to DeFi protocols

- Just 15% of South Korea’s $150 billion of cryptocurrency received went to DeFi protocols, while that figure rises to 32% for Japan

- Ethereum and wETH account for 21% of South Korea’s cryptocurrency transaction volume and 28% of Japan’s, versus 38% for both China and Hong Kong

- Middle East accounted for 7% of global cryptocurrency value at over $272 billion – a 1,500% growth YoY

- Despite that growth, Middle Eastern countries show relatively low grassroots adoption. Afghanistan is the highest ranked in the region on our Global Crypto Adoption Index at 20, followed by Turkey at 26

- 33% of all transaction activity in Turkey, for instance, can be attributed to DeFi platforms, while the figure is as high as 95% in Lebanon and as low as 16% in Iraq

- Research suggests that many in the Middle East have turned to cryptocurrency to preserve their savings against currency devaluation, a trend we see in other emerging markets like Africa and Latin America

- Africa accounted for only 3% of global cryptocurrency value at over $106 billion – 1,200% growth YoY

- Africa is the third-largest crypto economy with a bigger share of its overall transaction volumes made up of retail-sized transfers than any other region at just over 7% vs the global average of 5.5%

- No region uses P2P platforms at a higher rate than African cryptocurrency users, as they account for 1.2% of all African transaction volume

- Bitcoin accounted 2.6% of all African transaction volumes on P2P platforms

- Out of the top 50 coutries globally by crypto adoption, 13 are from Africa

- Africa has the highest rate of exposure to illicit addresses globally

- MyMTIClub.com is the largest scame in funds received across Africa

______________________

Read / Download the full report here

___________________________________________________________________

RECOMMENDED READING: Togo Leads Africa in Global DeFi Adoption, Says Latest 2021 Chainalysis DeFi Adoption Index

___________________________________________________________________

Thank you for your support by helping us create content:

BTC address: 3CW75kjLYu7WpELdaqTv722vbobUswVtxT

____________________________________________________________________

Follow us on Twitter for latest posts and updates

Join and interact with our Telegram community

_____________________

Subscribe to the channel below to keep updated on latest news on video:

___________________________________________________________________