According to data from a World Bank report, mobile money in Africa is more popular and has been more successful than traditional financial services combined over the last 4 years.

The new statistics show that mobile money adoption has largely been brought on by the low transaction fees making it possible for low-income customers, while high transaction volumes make mobile money profitable for service providers.

We featured the success of mobile money in Somalia in a recent post. However, it seems other African countries are also experiencing similar, and in some cases more, success in mobile money use and adoption.

Countries in Africa with Surging Mobile Money Accounts

While Kenya is no doubt a pioneer in mobile money, the rate of inclusion is greatest in countries with new products and services like Zimbabwe and Namibia.

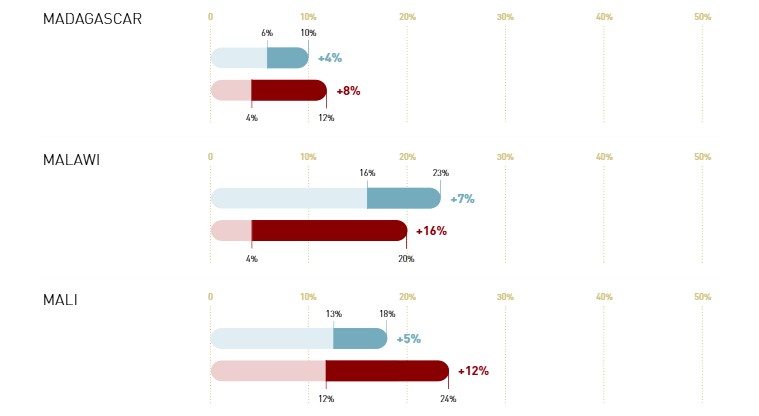

Below are some statistics on mobile money adoption across Africa:

From the above statistics, it is clear that the days of referring to ‘unbanked’ and ‘undeserved’ are limited. Populations that were once unreachable with traditional financial services such as the poor, rural populations, and women are now accessible with the help of mobile money services.