NFT sales are occuring at the lowest rate in more than a year, according to data we have tracked across multiple platforms.

Based on this NFT dashboard by abhi_0x on Dune Analytics, $26,147,513 in NFT sales occurred on 1st August 2022, which is a far cry from the $94,338,447 in sales on a similar date in 2021.

Furthermore NFT sales which crossed $1 billion in sales volume on 1st January 2022, before a dip in March 2022, have declined drastically in the latest quarterly results.

In the last 30 days alone, NFT sales have declined by 20.82%, to round off a difficult Q2 2022 for the sector that took over around the same time in 2021.

According to data available on analytics platform, Crypto Slam, the total sales volume for NFT sales over the last 30 days was $648, 775, 784, which came from 5,035,536 transactions.

A recent report by analytics platform, Nonfungible.com, highlights the drop in the market over the two quarters.

Non-fungible observed that ‘a massive 25% drop was observed in terms of USD traded between Q1 and Q2 2022 with a global volume of about US$8 billion in Q2 2022.’

Moreover, net profit in the industry dropped from $2.3 billion in Q2 2022 compared to $2.3 billion in the previous quarter.

In response to the drop-off, once cash-rich players in the industry are cutting down on costs to stay afloat, with some having to lay off workers.

The most high profile of these was OpenSea which announced on July 14 that it was cutting 20% of its workforce with CEO, David Finzer, indicating in a message on Twitter that, ‘the reality is that we have entered an unprecedented combination of crypto winter and broad macroeconomic instability.’

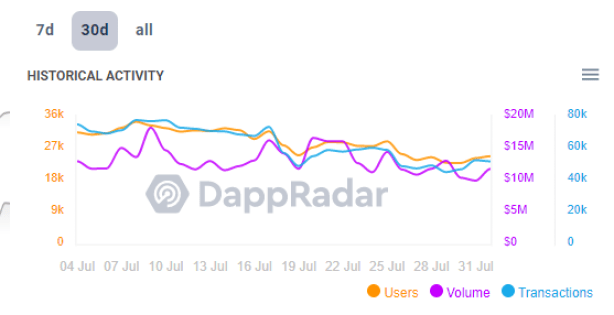

Activity on OpenSea, the world’s top NFT marketplace, has dropped over the last 30 days, with sales volume declining by more than 20%. This keeps with a decline in various metrics over that period, and can be seen from data that was visualized on DappRadar:

Other than Opensea, Immutable, a NFT gaming company, also announced laying off more than 20 staff, adding to the number of organizations in crypto that were laying workers off amidst a sustained downturn. The list includes:

- OpenSea

- Coinbase

- Immutable

- Gemini

- Crypto.com

However, the downturn in NFT and the wider crypto industry is being seen as a chance for more innovation and ideas to build in another period of crypto winter.

“During this winter, we’ll see an explosion in innovation across the ecosystem.

When the global economy is uncertain, our mission to build a foundational layer for new, peer-to-peer economies feels more urgent and important than ever.”

– CEO, OpenSea

It is not all doom and gloom as NFT based solutions continue to raise funds from investors including the latest Series A round by Unstoppable Domains which sent its valuation over $1 billion.

In Africa, Nigerian NFT marketplace, HashGreed, recently raised $1 million to expand its marketplace.