Bitcoin prices have been falling rapidly from a high of $10, 200 to below $8, 311 at some point, which has been attributed to margin calls and liquidations on BitMEX.

BitMEX, a Seychelles-based exchange, provides customers with 100x leverage. These are loans that multiply trader investments by a factor of 100x.

[Advertisement]

According to recent data, the situation has seen investors sell into a falling market to cut losses rather than hold long positions. The pressure to sell has led to a further market price decline.

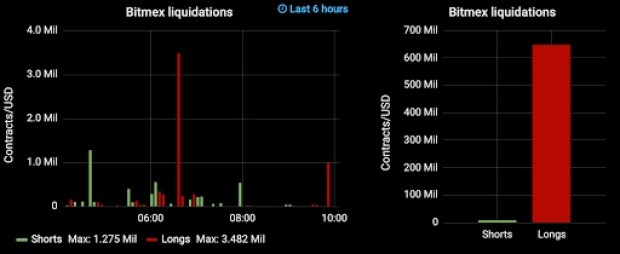

This is the lowest Bitcoin has been since early June 2019. The ferocious sell-off on BitMEX has resulted in a nearly 13% price drop which saw more than 600M long contracts liquidated on the exchange.

As a result, the crypto index is now at one of its lowest, positioned at level 15, which signifies extreme fear.

During a 2-hour sell-0ff period, BitMEX saw volumes worth $2.5B, one of the biggest trading days in months on the exchange. The two-hour window saw almost 6 percent of all long liquidations to date this year occur during this time.

The current price drop has been a concern for years where leveraged derivates exchanges like BitMEX can collapse Bitcoin’s price. This has in turn inspired non-leveraged initiatives like Bakkt’s futures product.

UPCOMING EVENT:

Sign Up for the upcoming Centonomy Cryptocurrency event featuring the Blockchain Association of Kenya, Lawyers Hub Kenya, and Luno Africa Crypto Exchange, on September 27th, 2019 in Nairobi, Kenya.

Like our content? Please support our work by tipping us.