2019 has so far been an amazing year for cryptocurrency. According to recent stats, there are now over 6,500 cryptocurrency apps across iOS and Google Play at the end of Q2, 2019. This is an increase of 35% since January 2018.

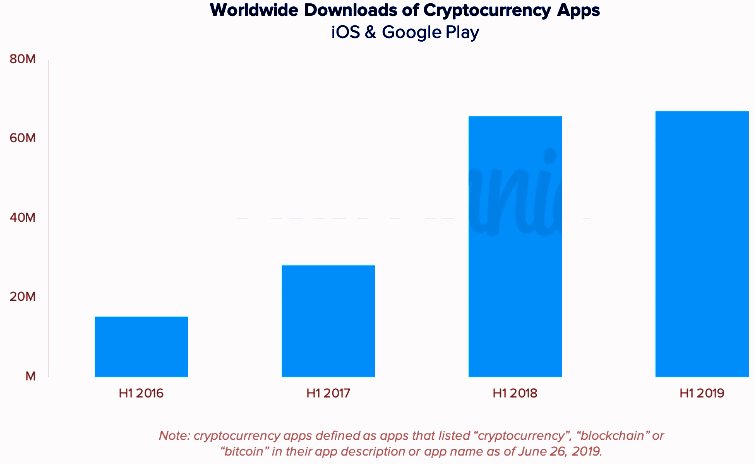

There have been 67 million downloads of cryptocurrency applications so far in 2019 alone. Research shows that demand is still high largely driven by the mobile and finance ecosystem.

Emerging markets are seeing the highest growth rates of finance apps, with some markets seeing a 400% growth in app downloads since 2016. This has largely been attributed to demand for banking and fintech apps that democratize finance services like investing, money transfers, consumer loans, and microloans as alternatives to credit cards.

Fintech apps are particularly interesting because they carve out large user bases and foster habit-forming behaviors. Mobile fintech apps tend to be quite sticky, with average users checking them nearly daily. Daily usage was up 35% in 2018 since 2016.

Below are some of the 2018 mobile stats that show why mobile is fueling this industry:

- 194 billion worldwide mobile app downloads in 2018

- $101 billion consumer spend in app stores in 2018

- 3 hours average user spend on mobile in 2018

- 360% high average IPO valuation for companies with mobile as core focus in 2018

- 30% high engagement in non-gaming apps for Generation Z vs. older demographics in 2018

- China accounts for nearly 50% of all app downloads in 2018

- Emerging markets represented 3 out of 5 downloads in 2018

- Mobile carved out 17% of daily time usage in emerging markets like Kenya and many African countries

- While games accounted for 65% of all app downloads, finance apps remained top 10 most downloaded apps, especially on iOS in 2018

With this background, we can now appreciate why cryptocurrency apps have been on the rise year-on-year since 2016.

Analysts predict the continued mainstream adoption as formalized regulations and increased acceptance of crypto payments from businesses grow.

In Kenya, a few businesses are already accepting crypto payments. The trend is likely to continue as conversation around digital currencies continue with the most recent coming from top regulatory and industry thought leaders across Africa spurring the debate further.